what you're reading

Houston startup secures funding, green project announces details, and more trending energy transition stories

Editor's note: It's been a busy news week for energy transition in Houston, and some of this week's headlines resonated with EnergyCapital readers on social media and daily newsletter. Trending news included a major funding win for Houston's hydrogen economy, startups named to new corporate-backed accelerator, and more.

Houston-area selected among 7 regions for $7B federal hydrogen hub investment

The HyVelocity Hub, representing the Gulf Coast region, will receive $1.2 billion to strengthen and further build out the region's hydrogen production. Photo via Getty Images

Not only has a Houston-area project been announced as one of the seven regions to receive a part of the $7 billion in Bipartisan Infrastructure Law funding to advance domestic hydrogen production — but the Bayou City is getting one of the largest pieces of the pie.

President Biden and Energy Secretary Jennifer Granholm named the seven regions to receive funding in a White House statement today. The Gulf Coast's project, HyVelocity Hydrogen Hub, will receive up to $1.2 billion — the most any hub will receive, per the release.

“As I’ve stated repeatedly over the past years, we are uniquely positioned to lead a transformational clean hydrogen hub that will deliver economic growth and good jobs, including in historically underserved communities," Houston Mayor Sylvester Turner says in a news release. "HyVelocity will also help scale up national and world clean hydrogen economies, resulting in significant decarbonization gains. I’d also like to thank all the partners who came together to create HyVelocity Hub in a true spirit of public-private collaboration.” Read more.

Houston expert on importance of messaging when scaling an energy transition company

Kelsey Hultberg, executive vice president of corporate communications and sustainability at Sunnova Energy, joins the Houston Innovators Podcast. Photo courtesy of Sunnova

Several years ago, Kelsey Hultberg decided to make a pivot. Looking for a role with career growth opportunities, the communications professional thought she'd find something at an oil and gas company, but then she met John Berger, founder and CEO of Sunnova, who was looking for someone to stand up their communications team amidst the solar energy company's growth.

"He hooked me," Hultberg shares on the Houston Innovators Podcast. "He said, 'I've got big plans for this company. I see where this energy industry is going, I see that we're prime for a transition, and I want to take this company public.' And I started a few weeks later."

Hultberg has been telling the story for Sunnova — which equips customers with solar and storage technology, providing them with energy independence — ever since, through scaling, new technologies, and its IPO in 2019. Read more.

Houston-based energy transition company to build innovative power, steam facility in Illinois

A Houston-based energy transition project developer announced its $1 billion project to provide cleaner energy to an Illinois-based agribusiness company. Photo via warwickcs.com

Broadwing Energy, a subsidiary of Houston-based energy transition company Warwick Carbon Solutions, is building a more than $1 billion natural gas facility in Illinois that’ll supply power for agribusiness giant Archer Daniels Midland and simultaneously reduce carbon emissions.

Construction is expected to start in 2025 and wrap up in 2028.

The natural gas plant will provide both electricity and steam for ADM’s processing operations in Decatur, Illinois, which consist of three facilities across more than 1,100 acres. CO2 “scrubbing” technology installed at the power plant will capture carbon emissions, which will then be kept in ADM carbon storage wells. Read more.

Greentown Labs names 6 energy tech startups to Shell-backed accelerator

Meet the six startups that will be working with Shell and Greentown Labs for the next six months. Photo via Greentown

Greentown Labs has named the six participating climatetech startups for an accelerator for a global energy leader.

Shell and Greentown Labs announced the cohort for Greentown Go Make 2023 — a program designed to accelerate partnerships between startups and corporates to advance carbon utilization, storage, and traceability solutions. Shell, which invests in net-zero and carbon-removal technologies, is hoping to strategically align with startups within carbon utilization, storage, and traceability across the energy transition spectrum.

“At Greentown Labs we recognize and appreciate the role energy incumbents must play in the energy transition, and we’re eager to facilitate meaningful partnerships between these impressive startups and Shell—not only to advance these technologies but also to help Shell achieve its sustainability goals,” Kevin Knobloch, CEO and President of Greentown Labs, says in a news release. “We know carbon utilization, storage, and traceability will play a critical role in our collective efforts to reach net-zero, and we’re enthusiastic about the potential impact these companies can have in that work.” Read more.

Houston cleantech co. secures investment from Mitsubishi

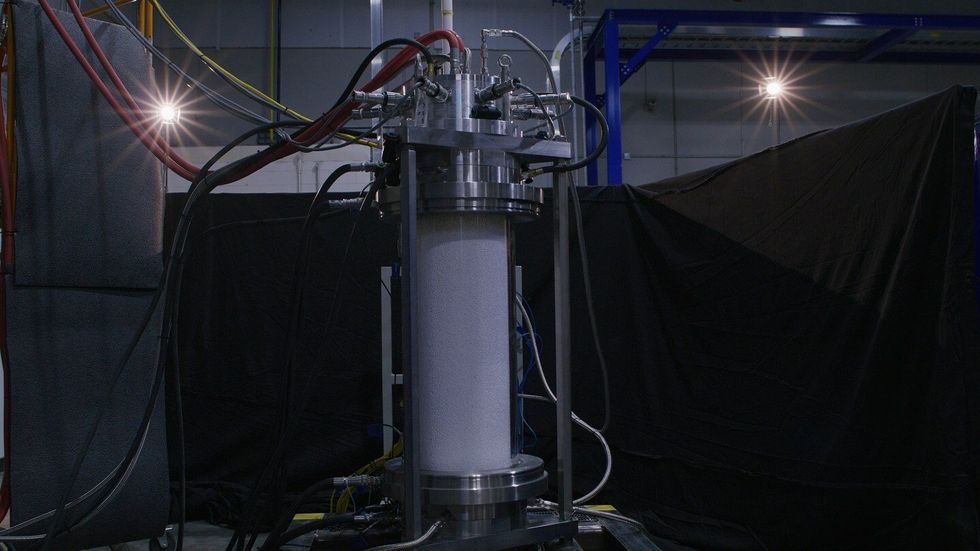

The undisclosed amount of funding will be used to continue Syzygy's work on it commercial-scale photoreactor. Photo via Syzygy

A Houston-based company that's created a photocatalytic reactor that uses light instead of heat to cleanly manufacture chemicals has announced its latest investor.

Syzygy Plasmonics announced a strategic investment agreement with Mitsubishi Heavy Industries Ltd., executed through Mitsubishi Heavy Industries America Inc. The terms of the deal were not disclosed, but Syzygy reports that the funding will go toward commercialization and development of its products.

"MHIA has been making moves to establish themselves as one of the leaders in the energy transition," Syzygy CEO Trevor Best says in a news release. "Formalizing our relationship with them shows their commitment to helping scale cutting edge technology and opens up new avenues for Syzygy and MHIA to work together as we commercialize our industrial decarbonization platform." Read more.