top stories

Texas sees new EV funding, M&A moves, and more trending Houston energy transition news

Editor's note: Looking back on the top news of the week, there are definitely some trends between electric vehicle moves and M&A activity. Scroll below for some of the top headlines that resonated with EnergyCapital readers on social media and daily newsletter this week.

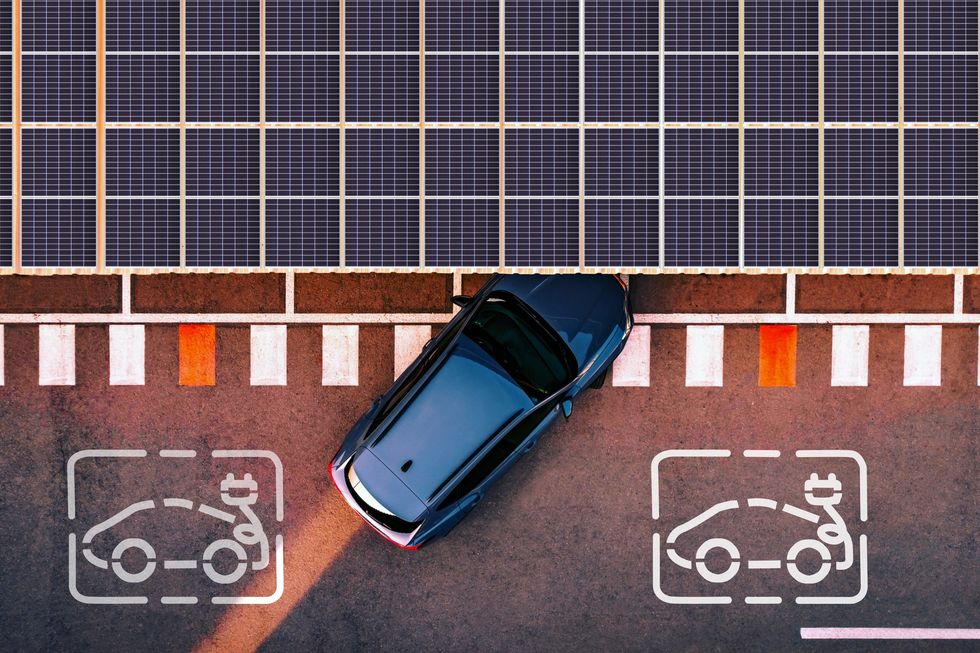

Texas to receive $70M to build EV charging network

The federal grants will fund 47 EV charging stations and related projects in 22 states and Puerto Rico, including 7,500 EV charging ports. Photo by Andrew Roberts/Unsplash

The Biden administration is awarding $623 million in grants to help build an electric vehicle charging network across the nation, and Texas is expected to see a chunk of that funding.

Grants being announced Thursday will fund 47 EV charging stations and related projects in 22 states and Puerto Rico, including 7,500 EV charging ports, officials said.

“America led the arrival of the automotive era, and now we have a chance to lead the world in the EV revolution — securing jobs, savings and benefits for Americans in the process,” said Transportation Secretary Pete Buttigieg. The new funding “will help ensure that EV chargers are accessible, reliable and convenient for American drivers, while creating jobs in charger manufacturing, installation and maintenance for American workers.” Continue reading.

Houston recycling company names new CEO

David Hudson has been named CEO of Elemental Recycling. Photo via LinkedIn

A Houston company that turns recycled plastics into high-purity graphene and hydrogen has named its new leader.

David Hudson has been named CEO of Elemental Recycling. The company, founded in 2019, is an investment of Freestone, a portfolio company of Tailwater Capital. He succeeds Tom Samuels, former CEO and board chair of the company.

"With over two decades of proven expertise in driving strategic growth and profitability across the recycling, waste management, sustainability, and decarbonization sectors, David brings a wealth of experience that makes him the ideal leader to take the reins and guide Elemental into its next phase of innovation and growth," Samuels says in a news release. "I am excited about the possibilities that lie ahead for the company under David's leadership. His proven track record and passion for driving positive change make him the perfect steward for the next chapter of Elemental's journey." Continue reading.

Houston energy PE firm acquires nuclear infrastructure company

Pelican Energy has acquired Container Technologies Industries, a manufacturer of containment solutions for the nuclear industry. Photo via containertechnologies.com

A Houston-based private equity firm has made a strategic acquisition.

Pelican Energy has acquired Container Technologies Industries from a group of private shareholders. CTI is a manufacturer of containment solutions for the nuclear industry and a certified HUBZone small-business whose customers include the U.S. Department of Energy, the U.S. Department of Defense and the commercial-nuclear space. Pelican makes investments in energy equipment and serves oil and gas companies and those in the nuclear sectors. Continue reading.

Texas finishes low on list of EV charging stations despite increased efforts in Houston

California, with its 14,500 charging stations, has more EV charging stations than New York, Florida, and Texas combined. Photo via Getty Images

In a new report that ranked states with the most electric vehicle chargers, Texas falls behind other similarly-sized states

The SmartAsset study looked at the closest EV charging stations equivalent to a trip to the gas station — factoring in each state's population. California, with its 14,500 charging stations, has five times the EV charging stations as New York (3,327), Florida (2,913) and Texas (2,472). While California ranked No. 1 on the list, Texas found itself at No. 41. Continue reading.

Houston energy company to combine with Chesapeake in $7.4B deal

Houston-based Southwestern Energy will combine with Oklahoma City-based Chesapeake Energy. Photo via swn.com

Chesapeake Energy and Southwestern Energy are combining in a $7.4 billion all-stock deal to form one of the biggest natural gas producers in the U.S.

There have been a string of deals in the energy sector, including the nearly $60 billion acquisition of Pioneer Natural Resources by ExxonMobil and a $53 billion deal between Chevron and Hess.

Southwestern shareholders will receive 0.0867 shares of Chesapeake common stock for each outstanding share of Southwestern common stock at closing.

Chesapeake shareholders will own about 60 percent of the combined company, while Southwestern shareholders will own approximately 40 percent. Continue reading.