Top Stories

UH breakthrough, Texas A&M grant, and more trending energy transition news for January

Editor's note: The first half of January 2025 has included exciting developments in the energy transition sector. Here are our five most-read EnergyCaptialHTX stories from January 1-14, from a University of Houston research breakthrough to HETI's look back at a successful 2024.

1. UH researchers develop breakthrough material to boost efficiency of sodium-ion batteries

A team at the University of Houston is changing the game for sodium-ion batteries. Photo via Getty Images

A research lab at the University of Houston has developed a new type of material for sodium-ion batteries that could make them more efficient and boost their energy performance.

Led by Pieremanuele Canepa, Robert Welch assistant professor of electrical and computer engineering at UH, the Canepa Research Laboratory is working on a new material called sodium vanadium phosphate, which improves sodium-ion battery performance by increasing the energy density.

The Canepa Lab used theoretical expertise and computational methods to discover new materials and molecules to help advance clean energy technologies. Continue reading.

2. Texas A&M awarded $1.3M federal grant to develop clean energy tech from electronic waste

The university will use the grant from the U.S. Department of Energy to develop a cost-effective, sustainable method for extracting rare earth elements from electronic waste. Photo via Getty Images

Texas A&M University in College Station has received a nearly $1.3 million federal grant for development of clean energy technology.

The university will use the $1,280,553 grant from the U.S. Department of Energy to develop a cost-effective, sustainable method for extracting rare earth elements from electronic waste.

The grant awarded to Texas A&M was among $17 million in DOE grants given to 14 projects that seek to accelerate innovation in the critical materials sector. Continue reading.

3. Houston Energy Transition Initiative celebrates milestones of 2024 amid global energy innovation

HETI looks back on three years. Photos courtesy

As it wraps up its third year, Jane Stricker and Bobby Tudor reflect on the Houston Energy Transition Initiative's three years of advancing Houston's leadership in the global energy transition through innovation, collaboration, and investment in a low-carbon future. Continue reading.

4. Houston manufacturer announces North Carolina as the location for its $193.7M facility

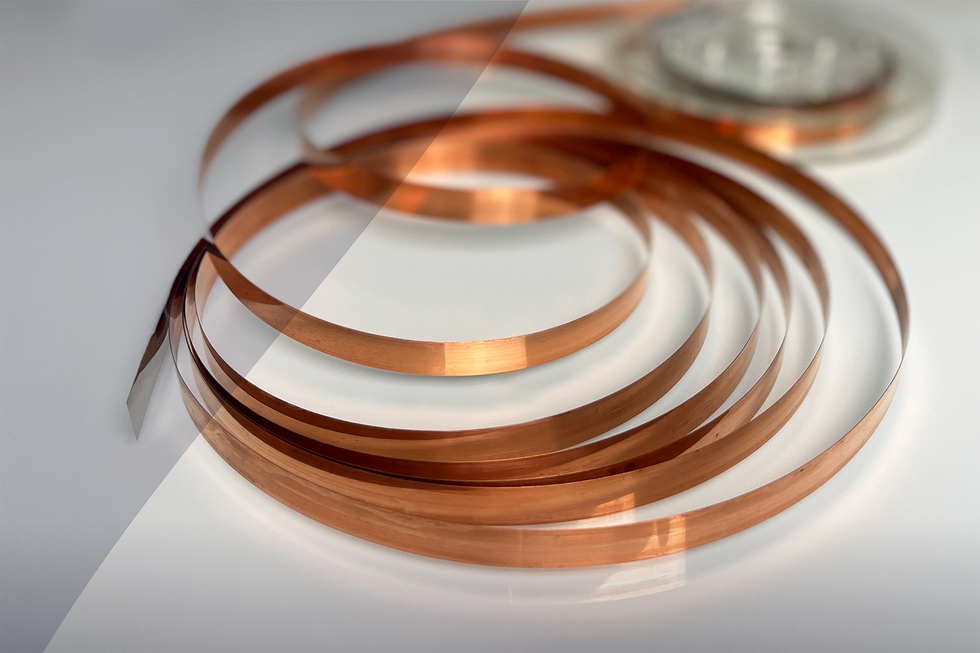

MetOx has named where its new facility will be going. Photo via metoxtech.com

Houston-based manufacturer of high-temperature superconducting wires MetOx International Inc. will build a major production facility in Chatham County, North Carolina, which is expected to create 333 jobs, and invest $193.7 million in the state.

MetOx is a leader in High Temperature Superconducting technology (HTS), which is an advanced power delivery technology that is capable of transmitting extremely high power at low voltage with zero heat generation or energy loss. The technology is assisting in the energy sectors like power transmission, distribution, and grid expansion. Continue reading.

5. DOE taps Texas and Louisiana organizations for new clean energy consortium

Nine organizations were named to the Department of Energy's new Regional Energy Democracy Initiative, which aims to "improve the well-being of communities burdened by the energy system. Photo via Getty Images

The U.S. Department of Energy (DOE) has chosen nine participants for the new Regional Energy Democracy Initiative (REDI), a consortium that will help guide clean energy projects in Texas and Louisiana.

“REDI’s pilot program will help ensure that communities in Texas and Louisiana — states that are poised to receive over $8 billion for carbon reduction and clean energy infrastructure projects — have the resources they need to help steer the historic clean energy investments in their backyards,” Jennifer Granholm, U.S. Energy Secretary, said in a statement. Continue reading.