New report ranks Texas in the middle for sustainable development

room to improve

Texas appears in the middle of the pack in a new ranking of the best states for sustainable development.

SmileHub, a nonprofit that rates charities, examined 20 key metrics to create its list of the best states for sustainable development. Among the metrics it studied were the share of urban tree cover, green buildings per capita and clean energy jobs per capita. Once SmileHub crunched all the numbers, it put Texas in 24th place — one notch above average.

The United Nations defines sustainable development as “meeting present needs without compromising the chances of future generations to meet their needs.”

Here’s how Texas fared in several of SmileHub’s ranking categories:

- No. 2 for water efficiency and sustainability

- No. 7 for presence of wastewater reuse initiatives

- No. 18 for environmental protection charities per capita

- No. 25 for green buildings per capita

- No. 34 for clean energy jobs per capita

- No. 34 for industrial toxins per square mile

- No. 38 for share of tree cover in urban areas

California leads the SmileHub list, followed by Vermont, Massachusetts, Oregon and Maryland.

When it comes to water, a 2024 report commissioned by Texas 2036, a nonpartisan think tank, recommends that Texas invest $154 billion over the next 50 years in new water supply and infrastructure to support sustainable growth, according to the Greater Houston Partnership.

“The report underscores a stark reality: a comprehensive, sustainable funding strategy for water is necessary to keep Texas economically resilient and competitive,” the partnership says.

- Here's how Texas ranks among the greenest states ›

- Report: Texas shines as top state for new solar, battery capacity ›

- New report calls for Houston-area health care providers to take action amid climate change ›

- Texas named most vulnerable state to climate change in new report ›

- Texas falls lower on WalletHub's Greenest States 2025 report - Energy Capital ›

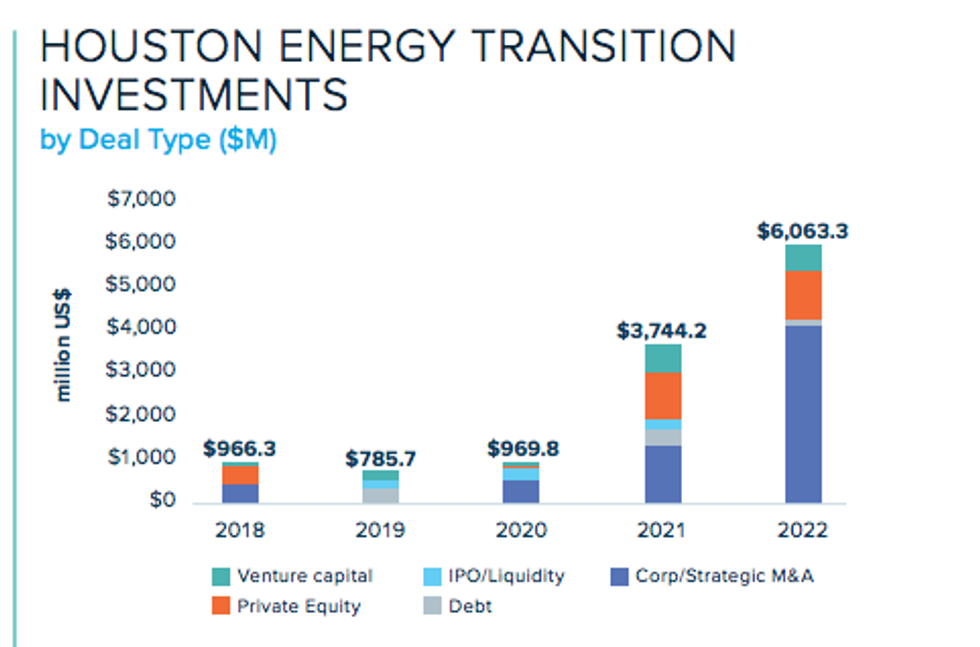

Source: GHP analysis of data from the U.S. Environmental Protection Agency, Greenhouse Gas Reporting Program (GHGRP)

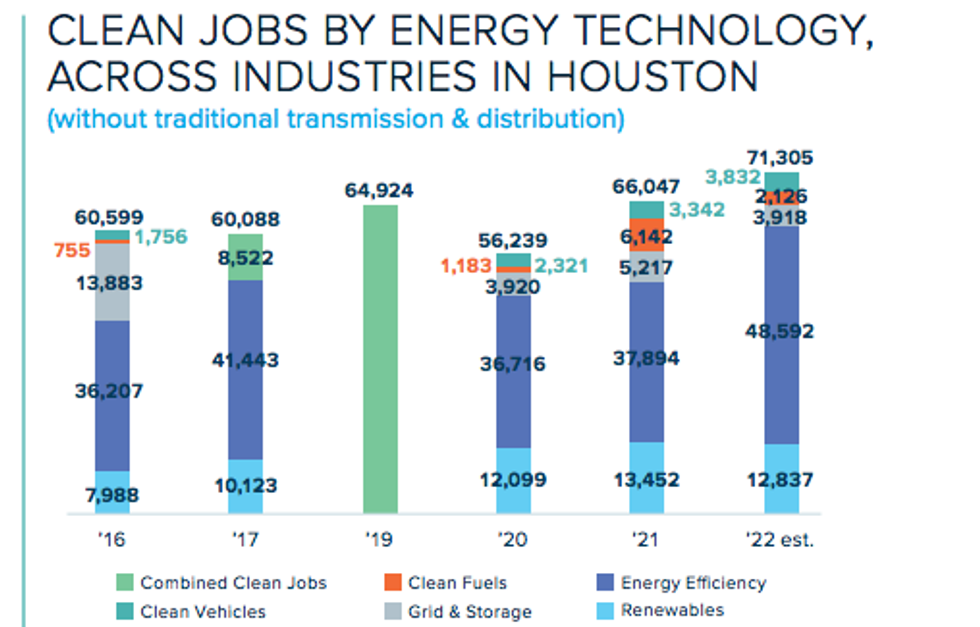

Source: GHP analysis of data from the U.S. Environmental Protection Agency, Greenhouse Gas Reporting Program (GHGRP) Source: GHP analysis and estimates of data from the U.S. Energy and Employment Report (USEER) and The Energy Futures Initiative (EFI), the National Association of State Energy Officials (NASEO), BW Research Partnership (BWRP) and E2 (Environmental Entrepreneurs)

Source: GHP analysis and estimates of data from the U.S. Energy and Employment Report (USEER) and The Energy Futures Initiative (EFI), the National Association of State Energy Officials (NASEO), BW Research Partnership (BWRP) and E2 (Environmental Entrepreneurs)