top stories

Talos makes $1.3B acquisition, Sunnova's new tech partner, and more trending Houston news

Editor's note: From a new Houston energy transition exec to strategic partnerships and acquisitions, these are the top headlines that resonated with EnergyCapital readers on social media and daily newsletter this week.

New leadership team named climate tech-focused organization for Texas college students

David Pruner will lead the Texas Entrepreneurship Exchange for Energy, known as TEX-E. Photo via LinkedIn

A collaborative initiative between several colleges and Greentown Labs has named its inaugural executive director.

David Pruner will lead the Texas Entrepreneurship Exchange for Energy, known as TEX-E, which is comprised of partners including Greentown Labs, MIT’s Martin Trust Center for Entrepreneurship, and universities across Texas. Additionally, Julia Johansson was appointed chief of staff for TEX-E and will oversee operations and administration responsibilities.

“Dave is the ideal leader for TEX-E to build on the great work that’s been done to develop a robust entrepreneurial energy ecosystem across these five impressive universities in Texas and to directly inspire and support university students to pursue entrepreneurial careers that will power our clean energy future,” Greentown Labs CEO and President Kevin Knobloch says in a news release. Continue reading.

Houston solar company taps new tech partner for energy management

Through the new partnership, Sunnova will fold the Lumin Smart Panel energy management platform into its Adaptive Home product. Images via luminsmart.com

Houston-based Sunnova Energy International, a provider of renewable energy for homes and businesses, has teamed up with Lumin, a maker of energy management technology, to roll out a new offering to homeowners.

Through the new partnership, Sunnova will fold the Lumin Smart Panel energy management platform into its Adaptive Home product. The partnership is scheduled to kick off in the first quarter of 2024.

Sunnova’s Adaptive Home combines solar power, battery storage, and smart energy management.Continue reading.

Houston energy company makes strategic acquisition in $1.29B deal

Talos, a technology-based energy company that aims to work towards low-carbon solutions, acquired QuarterNorth Energy Inc. Photo via talosenergy.com

Houston-based Talos Energy Inc. announced a $1.29 billion acquisition this month.

Talos, a technology-based energy company that aims to work towards low-carbon solutions, acquired QuarterNorth Energy Inc., which has ownership in several big offshore fields, and is a privately-held U.S. Gulf of Mexico exploration and production company. The acquisition of the assets are expected to provide additional scale from high quality deepwater assets “with a favorable base decline profile along with attractive future development opportunities” from QuarterNorth. Continue reading.

This Houston energy tech company to move the needle on building efficiency, air quality

After winning CodeLaunch last year, Matt Bonasera, enterprise architect at E360, looks forward to the future of the energy tech company. Photo by Natalie Harms/InnovationMap

Houston-based energy efficiency company Energy 360 is working to balance what is often viewed as a tradeoff between high quality clean air and energy efficiency within corporate buildings.

E360 is a subsidiary of InTech Energy, a software company that provides a variety of energy efficiency solutions for commercial spaces. The enterprise architect of E360, Matt Bonasera, says the platform functions as an energy management system as it monitors air quality, greenhouse gas emissions, and can adjust electricity usage among a host of other outputs.

“We are trying to holistically look at each building instead of just looking at it purely from the energy efficiency perspective or purely from looking at it from a health perspective,” Bonasera says. Continue reading.

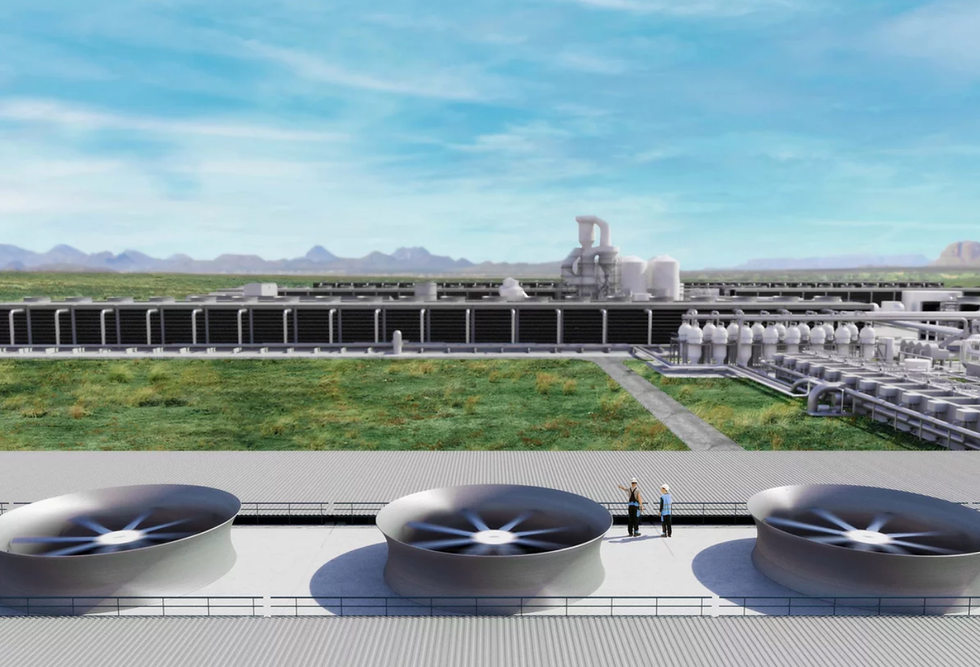

Oxy's sustainability subsidiary announces DAC agreement with commodities group

Here's 1PoinFive's newest customer on its Texas CCUS project. Photo via 1pointfive.com

Oxy's carbon capture, utilization and sequestration company announced it's latest carbon dioxide removal credits purchasing agreement with a global commodities group.

Trafigura has agreed to purchase carbon dioxide removal credits to be produced from 1PointFive’s first industrial-scale Direct Air Capture facility, Stratos, that is being built in Texas. Continue reading.