Show me the money: Top Houston energy transition funding, investment news from 2024

year in review

Editor's note: As the year comes to a close, EnergyCapital is looking back at the year's top stories in Houston energy transition. From firms with fresh funding to deploy to energy tech companies to startups raising venture capital investment, Houston has some wins to celebrate this year when you follow the money. Here were the top five most-read articles — according to EnergyCapital reporting — covering investment deals of 2024. Be sure to click through to read the full story.

Houston PE firm unveils oversubscribed $450M fund to advance nuclear power innovation

Pelican Energy Partners has raised more than it intended with its new nuclear-focused fund. Photo via Getty Images

Houston-based private equity firm Pelican Energy Partners has raised a $450 million fund to invest in nuclear energy services and equipment companies.

Pelican had aimed to raise $300 million for Pelican Energy Partners Base Zero LP and had imposed an initial “hard cap” of $400 million. Investors include endowments, foundations, family offices, and pension plans.

As of the fund’s closing date, the fund had wrapped up six investments, with several more deals expected to close by the end of this year. Continue reading.

Robotics co. with growing Houston presence closes series B

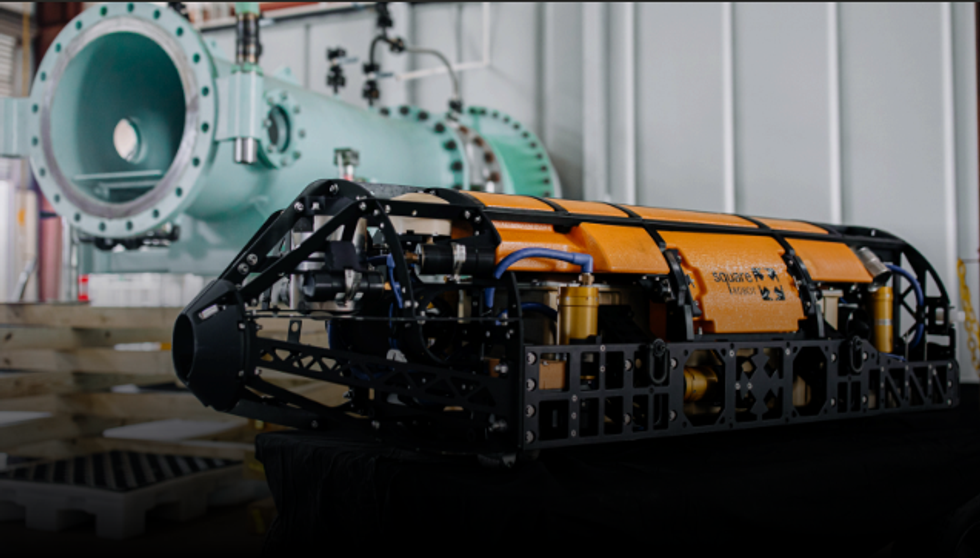

The advanced submersible robotics company will put the funds toward international expansion. Photo courtesy of Square Robot

Houston- and Boston-based Square Robot Inc. closed a series B round of funding last month.

The advanced submersible robotics company raised $13 million, according to Tracxn.com, and says it will put the funds toward international expansion.

"This Series B round, our largest to date, enables us to accelerate our growth plans and meet the surging global demand for our services,” David Lamont, CEO, said in a statement. Continue reading.

Houston industrial decarbonization-focused PE firm scores $725M to launch new business unit

HF Capital, the Knoxville, Tennessee-based investment arm of the Haslam family, made the multimillion-dollar commitment to set up Ara Energy Decarbonization. Photo via arapartners.com

Houston-based Ara Partners, a private equity firm that focuses on industrial decarbonization investments, is receiving up to $725 million from a Tennessee-based family office to launch an energy decarbonization unit.

HF Capital, the Knoxville, Tennessee-based investment arm of the Haslam family, made the multimillion-dollar commitment to set up Ara Energy Decarbonization. The new business will work toward reducing carbon emissions at ethanol plants, natural gas power plants, and other traditional energy assets.

The Haslam family founded Pilot Co., North America’s largest transportation fuel business and chain of travel centers. Shameek Konar, former CEO of Pilot, has been tapped to lead Ara Energy Decarbonization. Continue reading.

Houston-based clean energy site developer raises $300M to decarbonize big tech projects

As emerging technology continues to grow electricity load demand, Cloverleaf has identified an opportunity to develop large-scale digital infrastructure sites powered by low-carbon electricity. Photo via Getty Images

Houston energy executives have started a new company dedicated to developing clean-powered infrastructure for the large electric loads.

Cloverleaf Infrastructure, dually headquartered in Houston and Seattle, Washington, announced its launch and $300 million raised from NGP and Sandbrook Capital, two private equity firms. The company's management team also invested in the company.

As emerging technology continues to grow electricity load demand, Cloverleaf has identified an opportunity to develop large-scale digital infrastructure sites powered by low-carbon electricity.

"The rapid growth in demand for electricity to power cloud computing and artificial intelligence poses a major climate risk if fueled by high-emission fossil fuels," David Berry, Cloverleaf's CEO, says in a news release. "However, it's also a major opportunity to catalyze the modernization of the US grid and the transition to a smarter and more sustainable electricity system through a novel approach to development." Continue reading.

Investors from Houston and Boston fuel Greentown with $4M commitment

A mix of public and private investors have funded Greentown Labs. Photo via GreentownLabs.com

Greentown Labs, a climatetech incubator with locations in the Houston and Boston areas, has announced it has received funding from a mix of investors.

The $4 million in funding came from both of the Houston and Massachusetts locations. Houston investors included Bobby Tudor, CEO of Artemis Energy Partners and chairman of the Houston Energy Transition Initiative; David Baldwin, co-founder of OpenMinds and TEX-E and partner at SCF Partners; and Rice University. Other investors included MassDevelopment and the City of Somerville.

“The challenges of the energy transition are immense, and the role played by technology incubators like Greentown Labs is essential,” Tudor says in a news release. “We believe this role, which is a partnership between academia, industry, philanthropists, entrepreneurs, and governments, is the best way to get to effective, scalable solutions in a time frame that the urgency of the challenge requires. We need all hands on deck, and this partnership between Massachusetts and Texas can be a role model for others.” Continue reading.