Editor's note: From Caliche Development Partners finding fresh funding for a Beaumont plant to an energy transition SPAC going public, these are the top headlines that resonated with EnergyCapital readers on social media and daily newsletter this week.

Houston energy co. accelerates Beaumont storage expansion after key investment deal

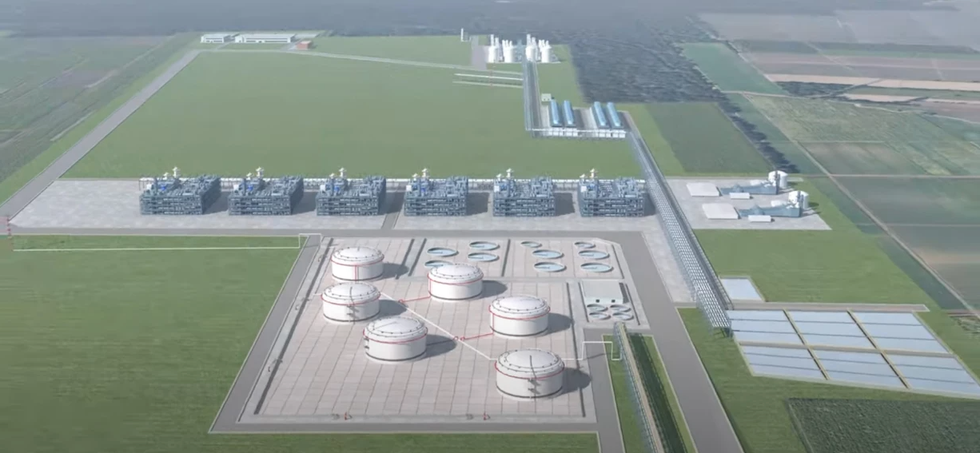

Houston-based Caliche Development Partners begins doubling natural gas storage capacity and building the world’s largest helium cavern, fueled by a key Texas deal completion. Photo courtesy of Caliche

With the acquisition of its Texas business now complete, Houston-based Caliche Development Partners is moving ahead with expansion of a natural gas storage project in Beaumont.

This milestone comes after a previously announced majority investment in Caliche by New York City-based investment firm Sixth Street, which has offices in Houston, Austin, and Dallas. Sixth Street recently closed on the Texas portion of the deal, and it expects to wrap up the California portion of the deal in mid-2025. Continue reading.

CenterPoint’s Greater Houston Resiliency Initiative makes advancements on progress

The GHRI Phase Two will lead to more than 125 million fewer outage minutes annually, according to CenterPoint. Photo via centerpoint.com

CenterPoint Energy has released the first of its public progress updates on the actions being taken throughout the Greater Houston 12-county area, which is part of Phase Two of its Greater Houston Resiliency Initiative.

The GHRI Phase Two will lead to more than 125 million fewer outage minutes annually, according to CenterPoint. Continue reading.

Houston group secures contract for major clean ammonia project in Louisiana

Houston global engineering firm McDermott will design a Louisiana project to produce millions of tons of clean ammonia. Image via cleanhydrogenworks.com

Houston-headquartered McDermott has received a new contract on a Louisiana clean ammonia project.

Clean energy development company Clean Hydrogen Works tapped McDermott for the front-end engineering and design contract for the Ascension Clean Energy Project. ACE — located in Ascension Parish, Louisiana — is jointly developed by CHW with strategic shareholders ExxonMobil, Mitsui O.S.K. Lines, and Hafnia and is expected to initially produce 2.4 million metric tons per annum of clean ammonia and expand to total 7.2 million metric tons per annum production down the road. Continue reading.

Houston energy SPAC goes public through IPO

Houston-based CO2 Energy Transition Corp., a SPAC focused on carbon capture, utilization, and storage (CCUS), raised $69 million in its IPO to target mid-sized CCUS companies. Photo via Getty Images

Houston-based CO2 Energy Transition Corp. — a “blank check” company initially targeting the carbon capture, utilization, and storage (CCUS) sector — closed November 22 on its IPO, selling 6 million units at $10 apiece.

“Blank check” companies are formally known as special purpose acquisition companies (SPACs). A SPAC aims to complete a merger, acquisition, share exchange, share purchase, reorganization or similar business combination in certain business sectors. CO2 Energy Transition will target companies valued at $150 million to $250 million. Continue reading.

Houston's hydrogen revolution gets up to $1.2B federal boost to power Gulf Coast’s clean energy future

The U.S. Department of Energy funding is earmarked for the new HyVelocity Hub. Photo via Getty Images

The emerging low-carbon hydrogen ecosystem in Houston and along the Texas Gulf Coast is getting as much as a $1.2 billion lift from the federal government.

The U.S. Department of Energy funding, announced November 20, is earmarked for the new HyVelocity Hub. The hub — backed by energy companies, schools, nonprofits, and other organizations — will serve the country’s biggest hydrogen-producing area. The region earns that status thanks to more than 1,000 miles of dedicated hydrogen pipelines and almost 50 hydrogen production plants. Continue reading.