It’s not every day that an entrepreneur gets grilled on their go-to-market-plans by a former presidential candidate, but for a few nascent businesses, that’s just what happened last Friday at Greentown Labs Houston.

Grilled is perhaps too strong a term, as Andrew Yang, an entrepreneur turned politician, conversed convivially with a half-dozen growing businesses in the thriving Innovation Corridor seated in midtown Houston. Yang listened carefully to each company’s elevator pitch, interrupting only to exclaim, “that’s so cool!” and “congratulations, man!” like an awestruck coed before asking thoughtful questions about the journey ahead for each entrepreneur.

Lara Cottingham, vice president of strategy, policy, and climate impact at Greentown Labs Houston, set the tone for the tour with an overview of Greentown Labs and the entrepreneurial efforts in energy transition it supports.

“[Greentown Labs was] founded 12 years ago. We’ve supported about 550 startups. Our startups have created over 24,000 jobs – and that’s just in Boston and Texas,” says Cottingham. “We don’t really know how to fully measure everywhere, but they are operating globally.

“Our startups have raised about $4 billion dollars. Half of that was last year,” Cottingham continues. “When we talk about now being the time to be in climatetech, now is the time.”

The tour begins with WIP International Services, a start up solving the problem of thirst and water scarcity by extracting moisture from humid environments and converting it into usable water.

WIP International Services aims to make drinking water more readily available in humid locations. Image via Shutterstock.

WIP International Services aims to make drinking water more readily available in humid locations. Image via Shutterstock.

“We can produce a purely distilled product, or a mineralized, pH balanced product for potable water,” explains Tracy L. Jackson, CEO of WIP International Services LLC.

The small group tagging along with Yang cheers the idea of creating clean water to drink while lowering the humidity of their homes, and effectively, their demand on energy for air-conditioning in a city that is now well into three-digit summer temperatures with average outdoor humidity above 70 percent.

Jackson almost stumbled into her startup by accident 8 years ago. She was visiting a site in Louisiana working on algae solutions, where she encountered an earlier (and much larger and noisier) model of the unit that stood in front of her now, no bigger than a standard water cooler. Inspired by scenes she witnessed in Africa during her tenure with an oilfield services company, Jackson knew this was a solution too good to keep quiet.

“Because I had been in Africa – I worked in an oil and gas services company – I had seen people standing in line for water from a water well in a village. And I thought, ‘this would be perfect for that situation,’” Jackson tells the tour group. “We now have developing relationships in Africa as well as Mexico on large scale projects for atmospheric water generation.”

At the next stop, Reid Carrazzone, president and CEO of Top Grain Technologies, softly explains how he and Zack Cordero, chief scientific officer, address the challenges of long-lead times and harsh environments impeding the ability to get hydrogen-fired turbines 100 percent hydrogen-fired.

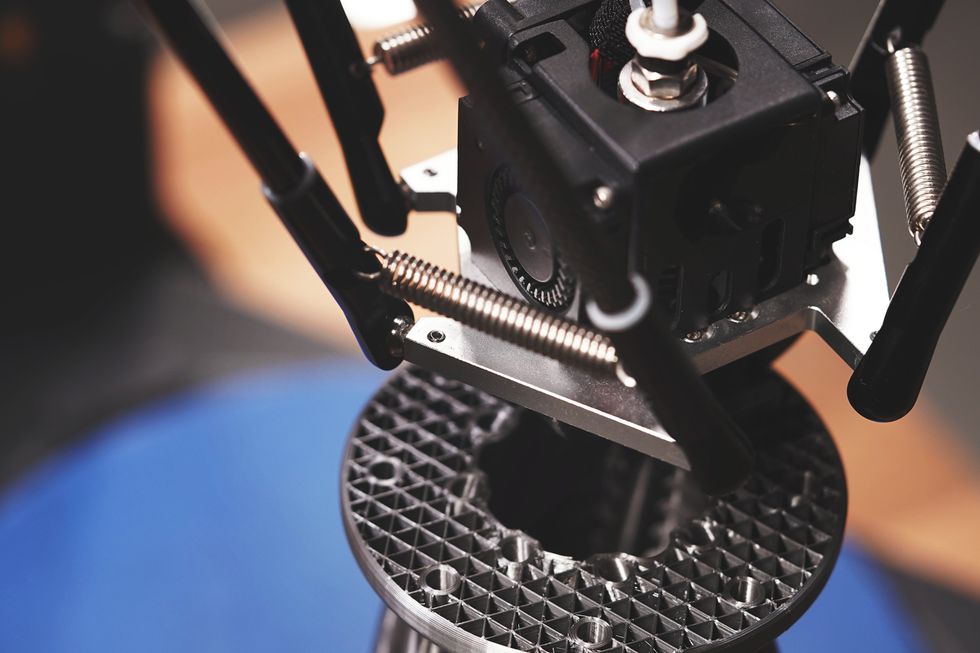

Top Grain Technologies resolves how to make 3D printed metals more heat resistant. Image via Shutterstock.

Top Grain Technologies resolves how to make 3D printed metals more heat resistant. Image via Shutterstock.

“We are commercializing a heat treatment invented at MIT that will enable 3D-printed metal materials to serve in combustion turbine engines,” Carrazzone tells Yang. “Traditionally, 3D-printed metals are not well-suited to serving the environments of high temperature/high stress that you’d find in jet engines and natural gas settings.

“These [3D-printed] materials, certain classes of them, can be uniquely hydrogen-compatible, as well as have temperature capabilities in excess of the existing materials today,” Carrazzone says. “They will need our heat treatment to bridge that final gap in properties.”

Yang lights up with at the prospect that the duo may have come up with a truly unique solution, even suggesting the company may be in a name-your-own-price situation. The Top Grain Technologies team accepts the compliment with humility, insisting it’s more about solving the simple problems one step at a time.

Companies that Yang met along the Greentown Labs workshop floor represent just a fraction of the innovation proliferating across Houston in recent years, each with a different focus on energy sustainability and the circular economy. Maybe one day Yang, Jackson, and Carrazzone will look back on this interaction and think, “I knew them when…” Only time, and continued tending to the entrepreneurial spirit, will tell.

WIP International Services aims to make drinking water more readily available in humid locations. Image via Shutterstock.

WIP International Services aims to make drinking water more readily available in humid locations. Image via Shutterstock. Top Grain Technologies resolves how to make 3D printed metals more heat resistant. Image via Shutterstock.

Top Grain Technologies resolves how to make 3D printed metals more heat resistant. Image via Shutterstock.