Oxy, other hardtech-focused organizations take up leases in Houston innovation hub

moving in

The Ion in Midtown has some new tenants taking up residence in its 90 percent-leased building.

Occidental Petroleum Corporation, Fathom Fund, and Activate are the latest additions to the Ion, according to a news release from Rice University and the Rice Real Estate Company, which own and operate the 16-acre Ion District where the Ion is located. With the additions, the building has just 10 percent left up for grabs.

“As the Ion continues to attract leading companies and organizations across industries, it’s clear that our vision of creating a dynamic and collaborative environment for innovation is resonating,” Ken Jett, president of the Rice Real Estate Company and vice president of facilities and capital planning at Rice, says in the release. “We are proud to set the standard for how the workplace can evolve to foster the commercialization and growth of transformative technologies that enhance quality of life in our community and beyond.”

Oxy, which was named a corporate partner of the Ion last year, now has nearly 6,500 square feet on the fourth floor. The build out process is slated to be completed by early 2025.

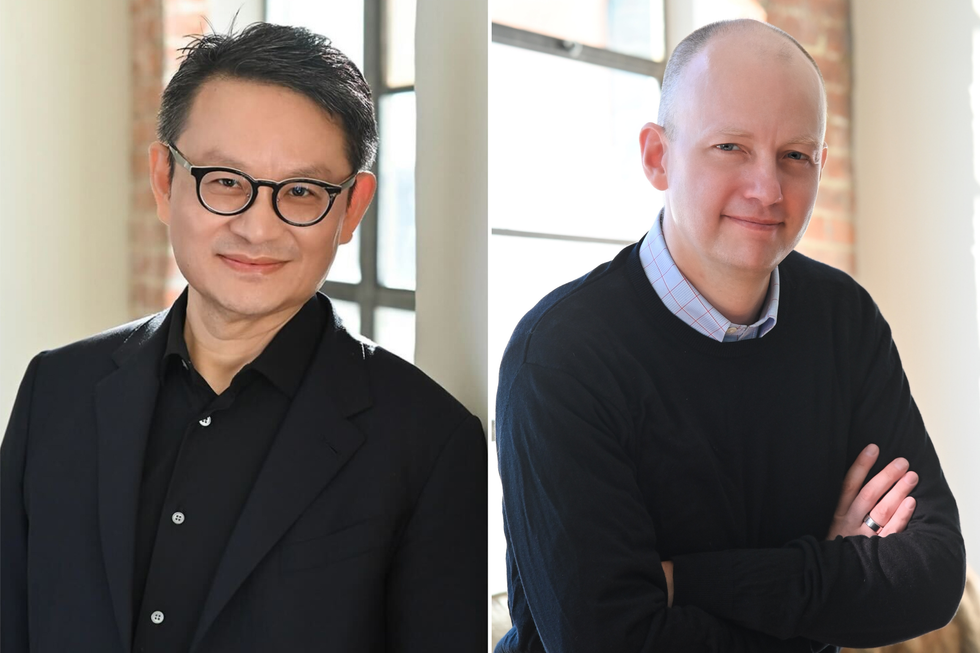

While Oxy represents the corporate side of innovation, the other two additions have their own roles in the innovation arena. Houston-based Fathom Fund, which launched its $100 million fund earlier this year, is targeting deep-tech venture opportunities and is led by Managing Partners Paul Sheng and Eric Bielke.

Founded in Berkeley, California, Activate, which announced its expansion into Houston in 2023, has officially named its local office in the Ion. The hardtech-focused incubator program recently named its inaugural cohort and opened applications for the 2025 program.

Other recent joiners to the Ion includes Kongsberg Digital, Artemis Energy Partners, CES Renewables, and Eleox.

“The partnerships we’ve forged are vital to shaping the Ion into a vibrant ecosystem for startups, where collaborative innovation is not only driving local economic growth but also positioning Houston as a global leader in the energy transition,” Paul Cherukuri, chief innovation officer at Rice University, says. “With our team leading the programming and activation across the Ion district, we are creating companies that harness cutting-edge technology for the benefit of society—advancing solutions that contribute to social good while addressing the most pressing challenges of our time. This powerful network is redefining Houston’s role in the future of energy, technology, and social impact.”

———

This article originally ran on InnovationMap.

- Oxy's cleantech arm scores Amazon DAC investment ›

- Oxy enters new partnership to demonstrate, deploy promising lithium technology ›

- DOE doles out $36M to Oxy for carbon capture hubs ›

- Oxy acquires carbon capture co. in $1.1B deal ›

- Oxy subsidiary secures Microsoft as largest-ever DAC carbon removal credit customer ›

- Oxy announces partnership to explore fusion technology in direct air capture facilities ›

- Oxy subsidiary gets $550M boost to form new CCUS joint venture ›

- Houston-based Oxy subsidiary receives $600M in federal funding for carbon capture project ›

- Is Enron back? Houstonians aren't laughing at the joke - Energy Capital ›

The new fund is founded by longtime investors Managing Partners Paul Sheng and Eric Bielke. Photos via ff.vc

The new fund is founded by longtime investors Managing Partners Paul Sheng and Eric Bielke. Photos via ff.vc