Houston has a legacy in in the energy industry — but can it remain the energy capital of the world? In short, yes.

That may sound counterintuitive, given that the energy system is transitioning — slowly, but inexorably — away from the city’s strengths in oil and gas. But that is the point: to an extent that may be overlooked, the O&G industry is critical to the transition, in two ways. Houston is well placed to take the lead on both.

First, there is the simple fact that oil and gas are essential, and will be for decades to come. About 99 percent of vehicles on the road right now use fossil fuels, and there are no readily available substitutes for their uses as feedstock for other industries, such as chemicals. Oil and gas account for almost 70 percent of US primary energy demand.

I do believe that their influence will diminish, as the energy system transitions to cleaner, lower-emission sources. McKinsey’s most recent Global Energy Perspective projected demand for oil will peak by 2027 and for gas a decade later. The International Energy Agency (IEA) sees the same evolution, but somewhat more slowly. Even after demand peaks, whenever that is, oil and gas will still be used, just not as much. I don’t see any reasonable scenario in which oil and gas disappears or is left in the ground for decades to come.

Second, and more interestingly, the O&G industry itself is essential to the goal of reducing greenhouse-gas emissions. If that sounds counterintuitive, too—well, it is. But bear with me. Under almost all emissions-reduction scenarios, carbon capture and storage (CCS), including direct air capture, and hydrogen play huge roles--accounting for more than 20 percent of future cuts in the IEA’s projection, for example. The Intergovernmental Panel on Climate Change also sees a big role for CCS, while noting that “global rates of CCS deployment are far below those in modelled pathways limiting global warming to 1.5°C or 2°C.” In other words, it matters, and there’s not enough of it. Hydrogen has been many people’s favorite technology of the future since at least the 1990s; the World Energy Council says it could account for as much as 25 percent of total final energy consumption by 2050, though likely less.

Let’s consider CCS first. This refers to reducing carbon-dioxide (CO2) emissions, particularly from industry, by capturing it on-site and then storing it underground: it is therefore never released into the atmosphere. Direct air capture sucks out carbon from the atmosphere, and then stores it. There is more than enough storage capacity, according to the IEA, and the technologies work.

Credit: Global CCS Institute

The problem has been regulation and economics—CCS is relatively expensive. About half of US emissions come from power generation and industry, such as cement; carbon capture works for both. And that is just what is possible now. Eventually, captured CO2 could be used to make a wide array of products, including building materials, carbon fiber, synthetic fuels, and plastics.

The Biden Administration is allocating $3.5 billion for direct air capture projects and $8 billion for hydrogen; those are not huge sums, given how costly large-scale energy projects are, but it just might be the beginning of bigger things. In addition, companies that have committed to net zero are beginning to put serious money behind carbon capture—almost $2 billion so far this year, compared to just $50 million in the past.

All this is relevant to Houston because Texas is the largest single US producer of both oil and gas, and these are the only players that now routinely use CCS, for gas processing and enhanced oil recovery. Houston is, by far, the national leader in carbon capture. Moreover, CCS can help to scale up “blue” or lower-emissions hydrogen, which could be an even bigger opportunity.

Hydrogen is not a source of energy, but a carrier of it. Once the hydrogen is produced—that is, separated from other elements, such as the oxygen in water—it can be stored and then released, either through combustion or via a fuel cell that converts hydrogen into electricity. Hydrogen could be used in a wide variety of ways, including powering vehicles, heating buildings, and fueling industry. Indeed, its potential is so broad and deep that the Hydrogen Council (with help from McKinsey) estimated late last year that hydrogen could contribute more than 20 percent of emissions abatement to 2050. The Council is a trade group and may therefore be a little optimistic (or a lot), but no one questions the potential of hydrogen in cutting emissions.

Right now, the primary use of hydrogen is in oil refining, which is one of Houston’s major industries. In addition, O&G companies are already looking into the conversion of methane in natural gas to hydrogen as well as the possibility of blending hydrogen into natural gas to lower the carbon content.

The Houston region already produces and consumes a third of the nation’s hydrogen, and is home to most of its dedicated hydrogen pipelines; its massive and efficient pipeline and transport system for gas can be adapted to move hydrogen. For the production of “green” or very-low emissions hydrogen, Houston also has a significant—and growing--renewable energy infrastructure. Indeed, if Texas was a country, it would be the world’s fifth-largest generator of wind power, and it is second in solar in the United States.

In short, when it comes to hydrogen, Houston is well ahead of the competitive pack, not only in physical terms, but in the human expertise that will count most of all to turn hydrogen from boutique to big. According to a recent report by the Center for Houston’s Future, Houston-based hydrogen assets could abate 220 million tons of carbon emissions by 2050, or more than half of Texas’s current emissions. Plus, it could create $100 billion in economic value.

The bottom line: there is no practical emissions reduction on the scale that the United States has committed to—net zero by 2050—without the development of CCS and hydrogen. And the O&G industry is leading the way in both these technologies. That puts Houston in an enviable position to both be part of the transition and to benefit from it. All told, according to the Houston Energy Transition Initiative, which includes 17 major energy-industry players, the region could gain up to 400,000 jobs in an accelerated scenario of adopting lower-carbon technologies. (McKinsey helped with this research, too.) To use a term beloved of consultants, that looks like a win-win.

Houston calls itself the “energy capital of the world”—and this isn’t a case of all hat and no cattle. The city is home to a critical mass of capital, innovation, expertise, and entrepreneurship. To continue to deserve that title, however, will require Houston to embrace the challenge of the energy transition: providing the reliable energy the world needs while also reducing emissions.

------

Scott Nyquist is a senior advisor at McKinsey & Company and vice chairman, Houston Energy Transition Initiative of the Greater Houston Partnership. The views expressed herein are Nyquist's own and not those of McKinsey & Company or of the Greater Houston Partnership. This article originally ran on LinkedIn.

WIP International Services aims to make drinking water more readily available in humid locations. Image via Shutterstock.

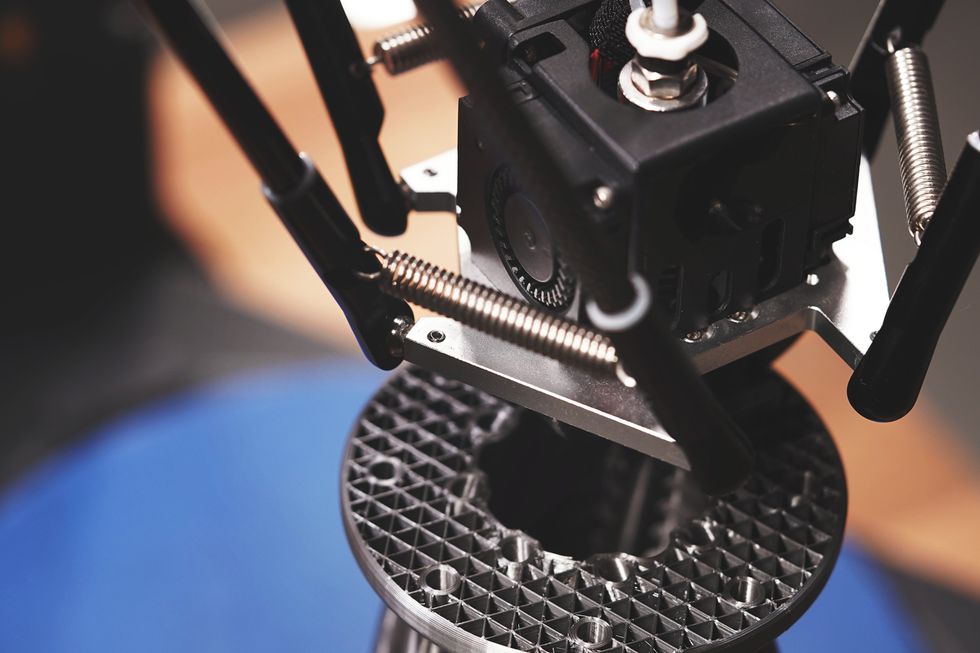

WIP International Services aims to make drinking water more readily available in humid locations. Image via Shutterstock. Top Grain Technologies resolves how to make 3D printed metals more heat resistant. Image via Shutterstock.

Top Grain Technologies resolves how to make 3D printed metals more heat resistant. Image via Shutterstock.