Big developments for Fervo, Hertha, Oxy, and more energy news to know

Trending Topics

Editor's note: There have been major developments in the local energy transition sector in September, including big funding for Hertha Metals, a powerful partnership for Fervo, and a launch on the horizon for Oxy. Below are the five most-read EnergyCaptialHTX stories from September 1-14.

1. Houston-area sustainable steel company emerges from stealth with $17M in VC funding

U.S. Rep. Morgan Luttrell, a Magnolia Republican, and Hertha Metals founder and CEO Laureen Meroueh toured Hertha’s Conroe plant in August. Photo courtesy Hertha Metals/Business Wire.

Conroe-based Hertha Metals, a producer of substantial steel, has hauled in more than $17 million in venture capital from Khosla Ventures, Breakthrough Energy Fellows, Pear VC, Clean Energy Ventures and other investors. The money has been put toward the construction and the launch of its 1-metric-ton-per-day pilot plant in Conroe, where its breakthrough in steelmaking has been undergoing tests. The company uses a single-step process that it claims is cheaper, more energy-efficient and equally as scalable as conventional steelmaking methods. The plant is fueled by natural gas or hydrogen. Continue reading.

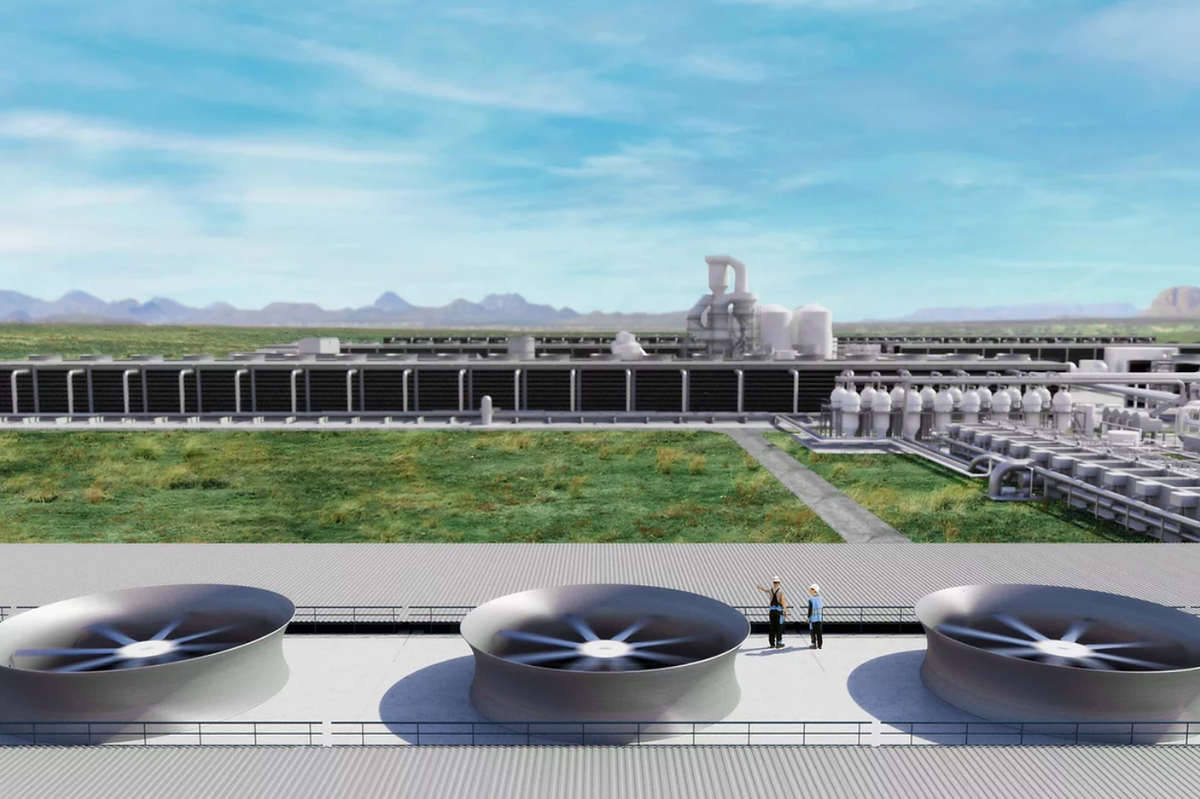

2. Fervo Energy selects Baker Hughes to supply geothermal tech for power plants

Fervo Energy has tapped Baker Hughes to supply technology to five power plants at Cape Station, its flagship geothermal power generation project in Utah. Photo courtesy Fervo Energy.

Houston-based geothermal energy startup Fervo Energy has tapped Houston-based energy technology company Baker Hughes to supply geothermal equipment for five Fervo power plants in Utah. The equipment will be installed at Fervo’s Cape Station geothermal power project near Milford, Utah. The project’s five second-phase, 60-megawatt plants will generate about 400 megawatts of clean energy for the grid. Financial terms of the deal weren’t disclosed. Continue reading.

3. Oxy's $1.3B Texas carbon capture facility on track to launch this year

Vicki Hollub, president and CEO of Occidental, said the company's Stratos DAC project is on track to begin capturing CO2 later this year. Photo via 1pointfive.com

Houston-based Occidental Petroleum is gearing up to start removing CO2 from the atmosphere at its $1.3 billion direct air capture (DAC) project in the Midland-Odessa area. Vicki Hollub, president and CEO of Occidental, said during the company’s recent second-quarter earnings call that the Stratos project — being developed by carbon capture and sequestration subsidiary 1PointFive — is on track to begin capturing CO2 later this year. Continue reading.

4. Houston foundation doles out $700K for Texas chemical research

The Welch Foundation has awarded funding through two of its newest grant programs. Photo via Getty Images.

Houston-based The Welch Foundation has issued $700,000 in additional funding to support chemical research through two of its newest grant programs. The foundation has named the recipients of its Welch eXperimental (WelchX) Collaboration Retreat and Pilot Grants and the Welch Postdoctoral Fellows of the Life Sciences Research Foundation Grants. The WelchX grants were awarded to teams of two Texas researchers who presented "innovative and collaborative ideas" addressing challenges in the clean energy space, according to the foundation. Continue reading.

5. 10+ Houston energy transition events to attend in September 2025

The 22nd annual Energy Tech Venture Forum takes place September 18. Photo courtesy of Rice

September is full of must-attend energy transition events. Get the details on the top energy happenings in September 2025, and begin registering today (some of the largest events happen this week). Continue reading.