Many Houstonians were holding their breath during the hard freezes that occurred in late January. While Winter Storm Uri was five years ago, the massive blackouts remain a fresh memory.

During that storm, 4.5 million Texans lost power, the state suffered over $80 billion in economic losses, and more than 200 people lost their lives.

During the most recent freeze events, Texas did not experience large-scale blackouts across the state like those in 2021. Regional power outages occurred due to infrastructure issues, including ice on trees and power lines. Since Uri, we have not seen the same sustained weather conditions to test the grid, but there have been significant improvements.

What Has Changed Since Uri

The ERCOT grid has changed significantly since the storm in 2021:

- Senate Bill 3 required generators to winterize their equipment, treated the natural gas supply chain as critical infrastructure, and imposed fines of up to $1 million for falling short. More than 300 power units have already been weatherized, and regulators have issued clearer standards to help keep the grid running during extreme cold.

- There has been significant progress with monitoring the grid and preparing for emergencies. ERCOT has improved in spotting problems before they turn into outages. Operators now have stronger real-time visibility into generator performance and fuel supplies, improved coordination with natural gas providers, and more advanced forecasting tools that help predict energy availability.

- The Texas Energy Fund authorized more than $10 billion for reliability projects across the state. The funds support four programs that aim to increase energy generation and dispatch capacity during periods of grid strain.

Signs of Progress

The grid's performance from 2022 to 2026 shows measurable improvements in how the system handles extreme cold.

- ERCOT has implemented conservation alerts to help reduce grid load and prevent major blackouts.

- Operators monitor the reserve margin, essentially the buffer between supply and demand. When that cushion holds, the grid has more flexibility to keep power flowing.

- Stronger coordination between generators, transmission operators and utilities is also improving overall system resilience.

Additionally, Texas has built one of the largest smart-meter networks in the country, enabling better predictive analysis of electricity demand and usage. These smart meters have been installed in 90% of Texas residential homes, providing a much more accurate picture of energy consumption.

Finally, energy companies are helping customers understand how small changes in usage can ease grid strain. Individually, those adjustments may seem minor, but across millions of homes, they can meaningfully lower demand and help reduce the risk of outages.

Remaining Vulnerabilities and Possible Risks

Despite the progress, Grid Strategies assigned the Texas power grid a D-minus rating this year. A major factor in the rating is Texas’s lack of connections to neighboring power grids. While the state earned a B for legislative engagement, delayed transmission projects contributed to a lower C-minus outcome score.

While the grid has become more reliable since 2021, several threats remain that could impede its continued progress.

- Population growth remains one of the biggest tests for Texas grid reliability. The state is expected to add roughly 15 million residents over the next three decades.

- Data centers, industrial expansion, and corporate relocations continue to drive electricity demand higher. Houston sits at the center of that growth, making it a key region to watch to see whether Texas can keep pace with rising energy needs.

- Increased weather volatility in Texas will make demand predictions even more challenging. Currently, Texas supplies almost 45% of its energy needs with natural gas. Natural gas production and extraction are particularly susceptible to cold weather and freezing conditions.

What “No Blackouts” Really Means for Texans

A stronger grid comes with a price tag. Meeting Texas’s growing demand requires major investments in generation, transmission, and emergency preparedness, and those costs ultimately flow to consumers through higher electric bills.

At the same time, Texans are becoming more proactive about managing energy use and protecting against outages, with more homeowners investing in generators, battery storage, and solar as part of long-term energy planning.

Final Thoughts

As lawmakers continue to debate how to recover grid investments, consumers will ultimately bear part of the cost. The challenge moving forward is improving reliability while keeping electricity affordable for Texans.

Texas continues to expand renewable generation to diversify the power mix, and battery storage is quickly becoming a key reliability tool because it can respond almost instantly to demand spikes. At the same time, advanced forecasting technology is helping operators better anticipate grid stress.

The Texas energy market is evolving fast, driven by population growth and rising electricity demand. Lawmakers, regulators, and grid operators will need to stay aligned to keep reliability moving in the right direction, while consumers will play a bigger role in managing how and when they use electricity.

So, is Texas better prepared for winter today? In many ways, yes. But the grid is still vulnerable to extreme weather and rapid demand growth. Maintaining reliability will require continued investment, planning, and coordination to keep the lights on across the state.

———

Sam Luna is director at BKV Energy, where he oversees brand and go-to-market strategy, customer experience, marketing execution, and more.

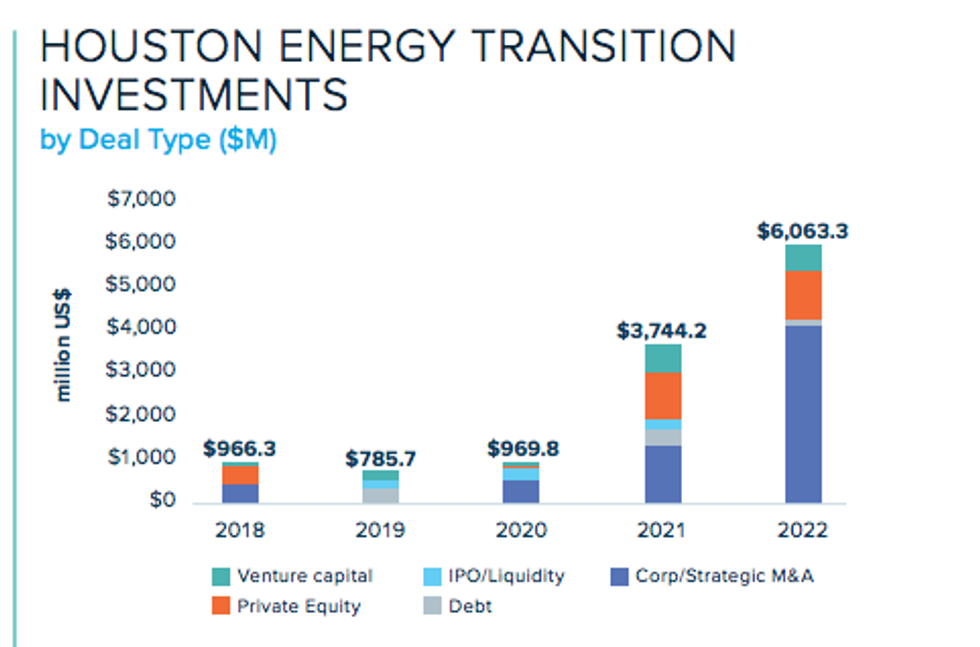

Source: GHP analysis of data from the U.S. Environmental Protection Agency, Greenhouse Gas Reporting Program (GHGRP)

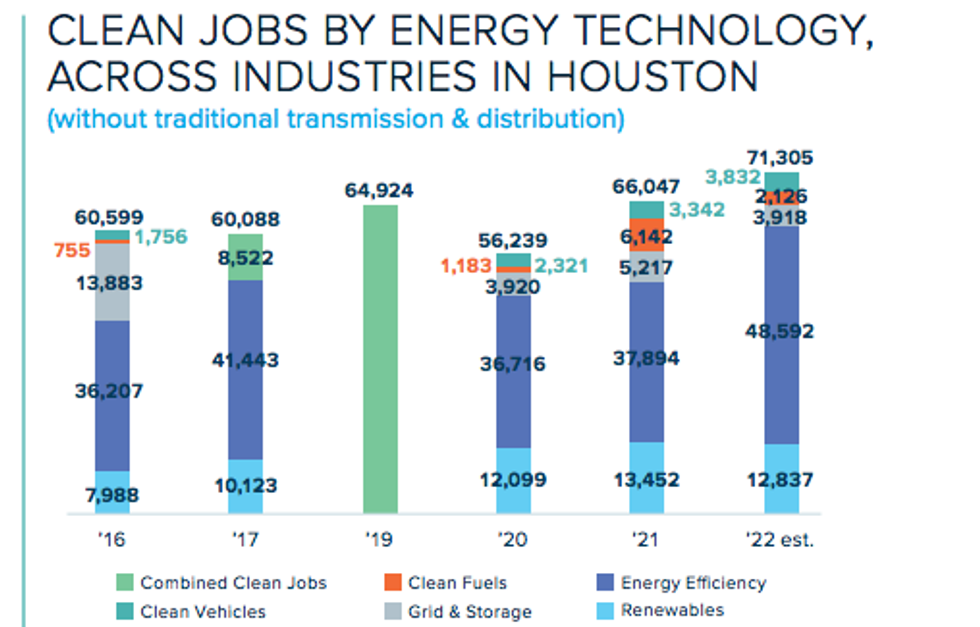

Source: GHP analysis of data from the U.S. Environmental Protection Agency, Greenhouse Gas Reporting Program (GHGRP) Source: GHP analysis and estimates of data from the U.S. Energy and Employment Report (USEER) and The Energy Futures Initiative (EFI), the National Association of State Energy Officials (NASEO), BW Research Partnership (BWRP) and E2 (Environmental Entrepreneurs)

Source: GHP analysis and estimates of data from the U.S. Energy and Employment Report (USEER) and The Energy Futures Initiative (EFI), the National Association of State Energy Officials (NASEO), BW Research Partnership (BWRP) and E2 (Environmental Entrepreneurs)