10+ exciting energy breakthroughs made by Houston teams in 2025

Year In Review

Editor's note: As 2025 comes to a close, we're revisiting the biggest headlines and major milestones of the energy sector this year. Here are the most exciting scientific breakthroughs made by Houstonians this year that are poised to shape the future of energy:

Rice University team develops eco-friendly method to destroy 'forever chemicals' in water

Rice University researchers have developed a new method for removing PFAS from water that works 100 times faster than traditional filters. Photo via Rice University.

Rice University researchers have teamed up with South Korean scientists to develop the first eco-friendly technology that captures and destroys toxic “forever chemicals,” or PFAS, in water. The Rice-led study centered on a layered double hydroxide (LDH) material made from copper and aluminum that could rapidly capture PFAS and be used to destroy the chemicals.

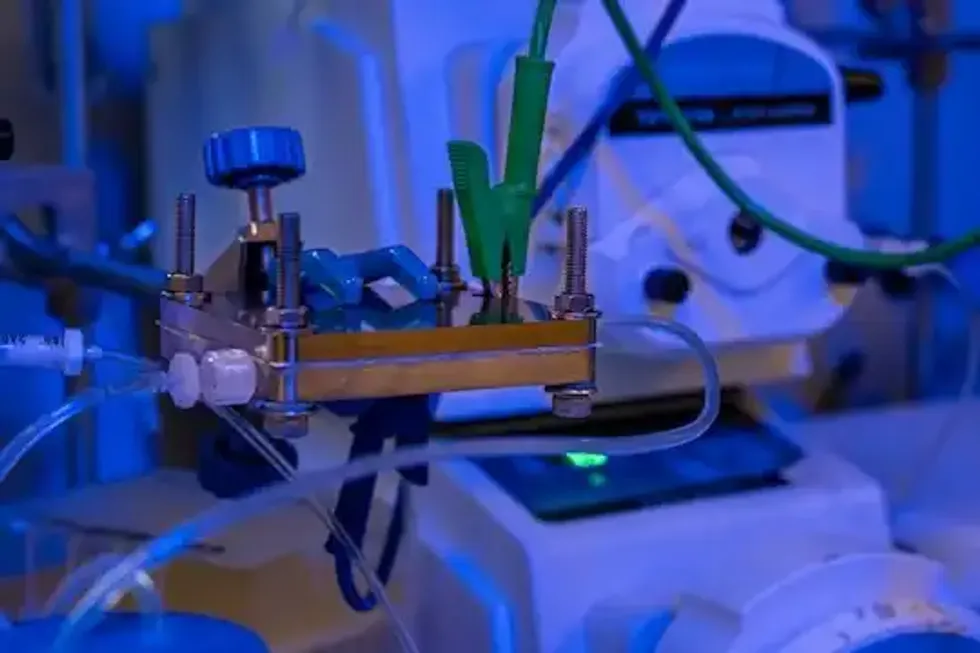

UH researchers make breakthrough in cutting carbon capture costs

A team from UH has published two breakthrough studies that could help cut costs and boost efficiency in carbon capture. Photo courtesy UH.

A team of researchers at the University of Houston has made two breakthroughs in addressing climate change and potentially reducing the cost of capturing harmful emissions from power plants. Led by Professor Mim Rahimi at UH’s Cullen College of Engineering, the team first introduced a membraneless electrochemical process that cuts energy requirements and costs for amine-based carbon dioxide capture during the acid gas sweetening process.The second breakthrough displayed a reversible flow battery architecture that absorbs CO2 during charging and releases it upon discharge.

Houston team’s discovery brings solid-state batteries closer to EV use

Houston researchers have uncovered why solid-state batteries break down and what could be done to slow the process. Photo via Getty Images.

A team of researchers from the University of Houston, Rice University and Brown University has uncovered new findings that could extend battery life and potentially change the electric vehicle landscape. Their work deployed a powerful, high-resolution imaging technique known as operando scanning electron microscopy to better understand why solid-state batteries break down and what could be done to slow the process.

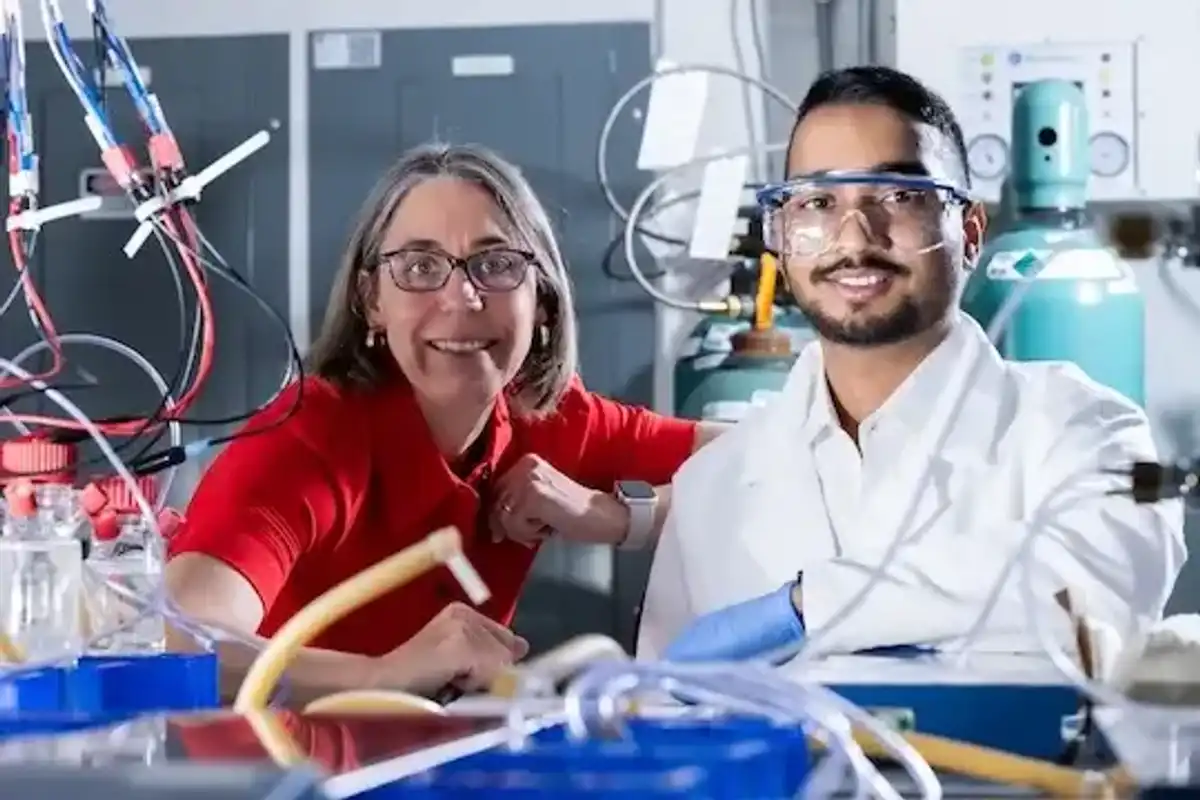

Houston researchers make breakthrough on electricity-generating bacteria

A team of Rice researchers, including Caroline Ajo-Franklin and Biki Bapi Kundu, has uncovered how certain bacteria breathe by generating electricity. Photo by Jeff Fitlow/Rice University.

Research from Rice University that merges biology with electrochemistry has uncovered new findings on how some bacteria generate electricity. Research showed how some bacteria use compounds called naphthoquinones, rather than oxygen, to transfer electrons to external surfaces in a process known as extracellular respiration. In other words, the bacteria are exhale electricity as they breathe. This process has been observed by scientists for years, but the Rice team's deeper understanding of its mechanism is a major breakthrough, with implications for the clean energy and industrial biotechnology sectors, according to the university.

Rice researchers' quantum breakthrough could pave the way for next-gen superconductors

Researchers from Rice University say their recent findings could revolutionize power grids, making energy transmission more efficient. Image via Getty Images.

A study from researchers at Rice University could lead to future advances in superconductors with the potential to transform energy use. The study revealed that electrons in strange metals, which exhibit unusual resistance to electricity and behave strangely at low temperatures, become more entangled at a specific tipping point, shedding new light on these materials. The materials share a close connection with high-temperature superconductors, which have the potential to transmit electricity without energy loss, according to the researchers. By unblocking their properties, researchers believe this could revolutionize power grids and make energy transmission more efficient.

UH researchers develop breakthrough material to boost efficiency of sodium-ion batteries

A team at the University of Houston is changing the game for sodium-ion batteries. Photo via Getty Images

A research lab at the University of Houston developed a new type of material for sodium-ion batteries that could make them more efficient and boost their energy performance. The Canepa Research Laboratory is working on a new material called sodium vanadium phosphate, which improves sodium-ion battery performance by increasing the energy density. This material brings sodium technology closer to competing with lithium-ion batteries, according to the researchers.

Houston researchers make headway on developing low-cost sodium-ion batteries

Houston researchers make headway on developing low-cost sodium-ion batteries

Houston researchers make headway on developing low-cost sodium-ion batteriesRice's Atin Pramanik and a team in Pulickel Ajayan's lab shared new findings that offer a sustainable alternative to lithium batteries by enhancing sodium and potassium ion storage. Photo by Jeff Fitlow/Courtesy Rice University

A new study by researchers from Rice University’s Department of Materials Science and NanoEngineering, Baylor University and the Indian Institute of Science Education and Research Thiruvananthapuram has introduced a solution that could help develop more affordable and sustainable sodium-ion batteries. The team worked with tiny cone- and disc-shaped carbon materials from oil and gas industry byproducts with a pure graphitic structure. The forms allow for more efficient energy storage with larger sodium and potassium ions, which is a challenge for anodes in battery research. Sodium and potassium are more widely available and cheaper than lithium.

Houston scientists develop 'recharge-to-recycle' reactor for lithium-ion batteries

Rice University scientists' “recharge-to-recycle” reactor has major implications for the electric vehicle sector. Photo courtesy Jorge Vidal/Rice University.

Engineers at Rice University have developed a cleaner, innovative process to turn end-of-life lithium-ion battery waste into new lithium feedstock. The findings demonstrate how the team’s new “recharge-to-recycle” reactor recharges the battery’s waste cathode materials to coax out lithium ions into water. The team was then able to form high-purity lithium hydroxide, which was clean enough to feed directly back into battery manufacturing. The study has major implications for the electric vehicle sector, which significantly contributes to the waste stream from end-of-life battery packs.

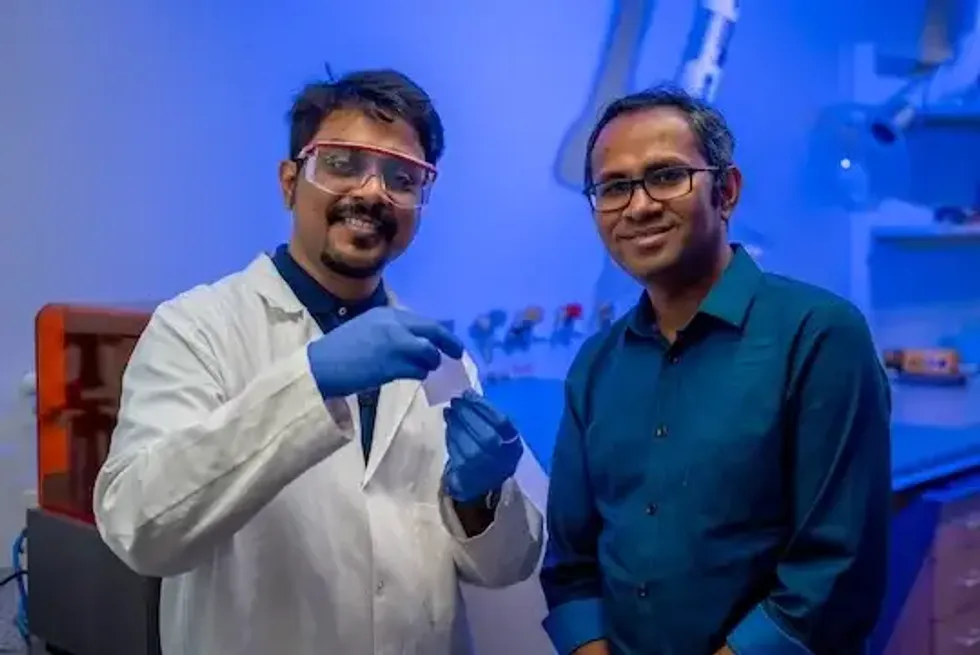

Houston researchers develop strong biomaterial that could replace plastic

A team led by M.A.S.R. Saadi and Muhammad Maksud Rahman has developed a biomaterial that they hope could be used for the “next disposable water bottle." Photo courtesy Rice University.

Collaborators from two Houston universities are leading the way in engineering a biomaterial into a scalable, multifunctional material that could potentially replace plastic. The study introduced a biosynthesis technique that aligns bacterial cellulose fibers in real-time, which resulted in robust biopolymer sheets with “exceptional mechanical properties.” Ultimately, the scientists hope this discovery could be used for the “next disposable water bottle,” which would be made by biodegradable biopolymers in bacterial cellulose, an abundant resource on Earth. Additionally, the team sees applications for the materials in the packaging, breathable textiles, electronics, food and energy sectors.

Houston researchers reach 'surprising' revelation in materials recycling efforts

A team led by Matteo Pasquali, director of Rice’s Carbon Hub, has unveiled how carbon nanotube fibers can be a sustainable alternative to materials like steel, copper and aluminum. Photo by Jeff Fitlow/ Courtesy Rice University

Researchers at Rice University have demonstrated how carbon nanotube (CNT) fibers can be fully recycled without any loss in their structure or properties. The discovery shows that CNT fibers could be used as a sustainable alternative to traditional materials like metals, polymers and the larger, harder-to-recycle carbon fibers, which the team hopes can pave the way for more sustainable and efficient recycling efforts.