New energy networking app, events you can't miss, and more things to know in Houston this week

Hou knew?

Editor's note: It's a new week — start it strong with three quick things to know in Houston's energy transition ecosystem. Meet the new leaders of ERCOT, an app you probably should download, and events not to miss this week.

Energy networking: There's an app for that

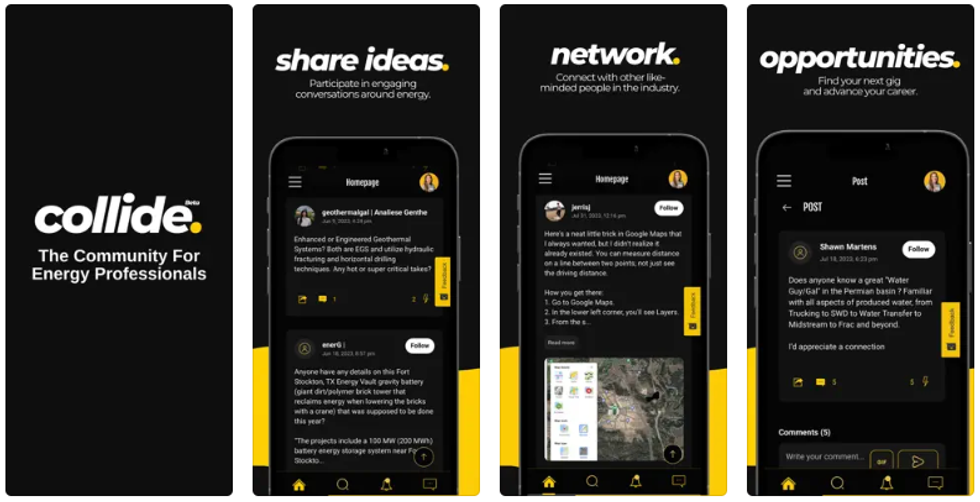

This Houston-based media company launched a networking platform to help solve the energy crisis. Screenshots via apps.apple.com

The Digital Wildcatters have created a platform for individuals to get their questions answered by experts and a space for companies seeking qualified talent. Collide is structured to ignite the next generation of energy innovators, as Collin McLelland, co-founder and CEO of Digital Wildcatters, tells EnergyCapital.

“If you look at what we’ve done historically with Digital Wildcatters, we’ve built an extremely engaged community of energy professionals — it’s a next generation community, very young forward thinking professionals that are working towards solving the world’s energy crisis,” McLelland says.

The roll out of Collide has been intentionally gradual, McLelland says because they want to shape the user experience based on feedback from ongoing focus groups. Currently they have about 1,000 users and are examining how they can make the app valuable to them before providing the platform to a wider audience.

McLelland says there are two major issues within the energy sector that Collide hopes to address — a lack of knowledge about energy verticals and difficulty recruiting talent.

“What we really see with our platform is being able to bring people together where if you want to find a piece of information, you need to find a subject matter expert, or if you want to find your next job, it happens on the Collide platform,” McLelland says. Read the full story.

Upcoming must-attend events to put on your radar

Two events this month the energy transition community needs to know about. Photos by Jeff Fitlow/Rice University

- September 14-15 — The Ninth Annual Digitalization in Oil & Gas Conference will focus on digitalization, decarbonization, and innovation within the energy industry across five tracks: IoT, blockchain, digital twins, edge computing, and connectivity for upstream, midstream, and downstream operators.

- September 21 — The Rice Alliance Energy Tech Venture Forum is an opportunity to learn about the latest emerging technologies, meet investors to seek funding, see promising companies, and more.

People to know this week

A quick who's who roundup from last week's EnergyCapital coverage. Photo via Getty Images

Missed some of EnergyCapital's news from last week? Catch up on who to know here.

- The Electric Reliability Council of Texas, or ERCOT, announced a reorganization amongst its leadership. Effective September 1, four ERCOT leaders have new titles and positions: Woody Rickerson has been named to the newly created position of senior vice president and COO; Kristi Hobbs, who previously served as vice president of corporate strategy and public utility commission relations, will replace Rickerson as vice president of system planning and weatherization and will report directly to Rickerson; Betty Day, vice president of security and compliance and chief compliance officer, has assumed oversight of business continuity; and Rebecca Zerwas will serve as director of state policy and public utility commission relations, board liaison. Read the full story.

- Launched in 2022, The Texas Southern University Division for Research & Innovation is spearheading the institutions efforts in attaining the highest-tier classification for research in higher education institutions. Michelle Penn-Marshall, who serves as vice president for the division, recently sat down with the Houston Energy Transition Initiative to talk about the university’s mission to become a leader in research and the long-term goals for engaging students in the energy sector and advancing the energy transition. Read the full story.

- With over a billion cars currently on the road — each with four tires that will eventually end up discarded, one Houstonian is hoping to create the infrastructure to sustainably dispose of tire waste now and into the future. Vibhu Sharma founded InnoVent Renewables to establish production facilities that utilize a proprietary continuous pyrolysis technology that is able to convert waste tires, plastics, and biomass into fuels and chemicals. In a Q&A with EnergyCapital, Sharma explains his plans to sustainably impact the tire waste space and his vision for his company. Read the full story.

Images via ERCOT.com

Images via ERCOT.com