Houston is at the heart of an 'all of the above' energy transition strategy

the view from heti

As the Houston region continues to have important conversations about energy and climate in the energy capital of the world, it’s helpful to frame the discussion in terms of the dual challenge.

On one hand, our world needs energy companies across all sectors to continue to develop and deliver energy for all parts of the world – energy that is affordable and reliable and can enable the level of population and GDP growth anticipated over the next 30 years. At the same time, we need to find a way to significantly reduce the greenhouse gas emissions associated with the production and distribution of that energy to reduce the risks and impacts associated with climate change on our world.

As the global energy landscape continues to evolve – across the entire value chain, just in the two years since HETI was launched, there is an even greater urgency to leverage all available solutions to address the dual challenge.

We must be able to recognize that there is no silver bullet, no single technology and no single source of energy today that can get the world to net zero by 2050. However, that doesn’t mean we should give up. As the energy transition capital of the world, Houston continues to demonstrate that can lead in developing and deploying “all of the above” energy solutions needed to reach our ambitious goals.

With over 200 new cleantech and climatetech startups alongside some of the largest energy leaders who know how to scale technology, Houston is uniquely positioned to lead the way in technology development and commercial deployment to meet the dual challenge. Whether it’s implementing a carbon capture and storage project along Houston’s ship channel, piloting small modular nuclear reactor technology to enable zero carbon energy for chemical production in Seadrift, or converting an abandoned landfill in the middle of Houston’s Sunnyside community into the largest urban solar farm in the U.S. to create both zero carbon power and economic opportunity for the community, Houston is charging forward on all fronts to meet the dual challenge.

We cannot afford to sacrifice progress in search of a perfect solution, and Houston embraces this perspective in the way our region is coming together across the entire energy ecosystem to build on our leadership and lead the world to an energy-abundant, low-carbon future.

------

This article originally ran on the Greater Houston Partnership's Houston Energy Transition Initiative blog. HETI exists to support Houston's future as an energy leader. For more information about the Houston Energy Transition Initiative, EnergyCapitalHTX's presenting sponsor, visit htxenergytransition.org.

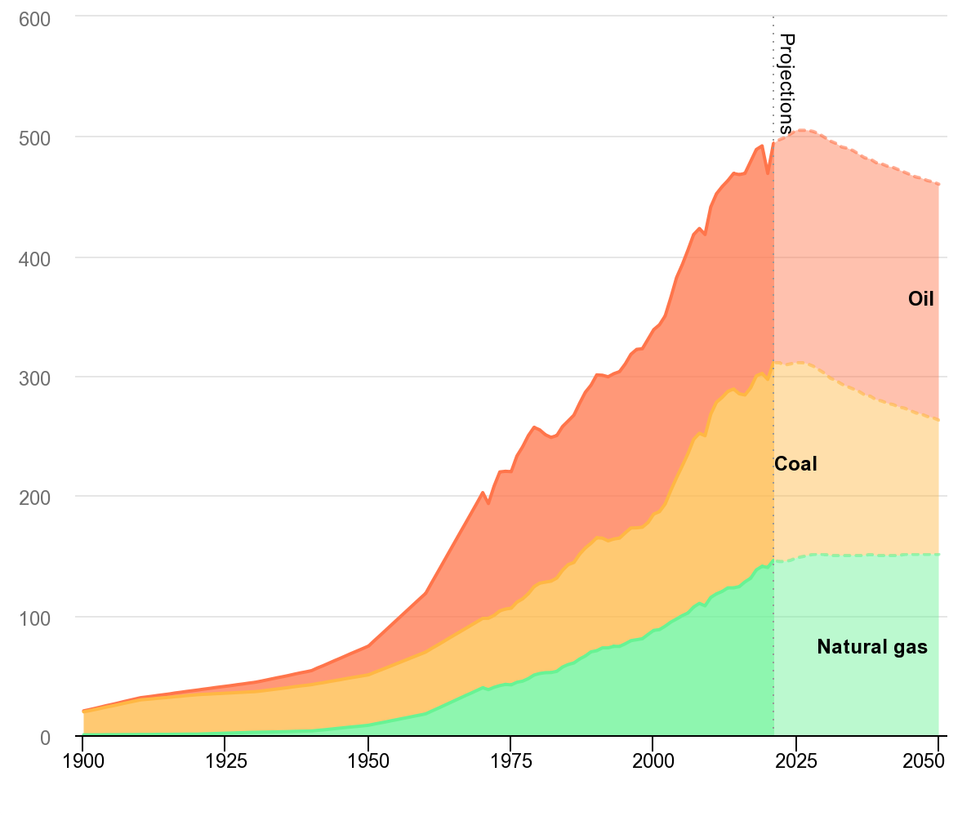

Demand for natural gas and oil are expected to level out, as demand for coal shrinks to meet goals for lower carbon emissions. Photo courtesy of IEA, license CC by 4.0Demand for natural gas and oil are expected to level out, as demand for coal shrinks to meet goals for lower carbon emissions. Photo courtesy of IEA, license CC by 4.0

Demand for natural gas and oil are expected to level out, as demand for coal shrinks to meet goals for lower carbon emissions. Photo courtesy of IEA, license CC by 4.0Demand for natural gas and oil are expected to level out, as demand for coal shrinks to meet goals for lower carbon emissions. Photo courtesy of IEA, license CC by 4.0