Top 10 headlines that fueled Houston energy transition news in 2025

Year in Review

Editor's note: As we ring in a new year, we're looking back at the hottest energy transition topics of 2025. Here are the 10 most-read EnergyCapitalHTX stories of 2025, from a Texas energy startup's $200M funding round to a Houston energy storage company's major ERCOT deal:

Texas energy startup closes $200M round to fund first factory in the state

Base Power, founded by Justin Lopas and Zach Dell, closed a $200 million series B and plans to expand in Texas and around the country. Photo courtesy Base Power.

Base Power, an Austin-based startup that provides battery-powered home energy services and just entered the Houston market, raised $200 million in series B funding. The money was raised for construction of Base Power’s first factory in Texas and the national expansion of Base Power’s services. Last year, the startup landed $68 million in a series A funding round.

Houston startup secures $22 million for ERCOT energy storage projects

Houston's GoodPeak is breaking ground on its first energy storage projects. Photo via Getty Images.

Houston-based GoodPeak nailed down $22 million in construction debt financing to help build its first two 10-megawatt battery energy storage project. GoodPeak secured the debt financing from financial services company Pathward and renewable energy lender BridgePeak Energy Capital.

CenterPoint partners with AI and infrastructure companies to boost reliability

CenterPoint has partnered with Atlanta-based Osmose and Australia-based Neara to use AI-powered predictive modeling to inform decisions on restorations and risk. Photo via Getty Images

Houston utilities giant CenterPoint is partnering with companies from Atlanta and Australia to use AI to increase data accuracy and strengthen the power grid. The partnership is part of a collaboration between AI-powered predictive modeling platform company Neara and utility infrastructure asset assessment solutions company Osmose.

ExxonMobil, Rice launch sustainability initiative with first project underway

Under a new agreement, ExxonMobil and Rice University aim to develop “systematic and comprehensive solutions” to support the global energy transition. Photo via Getty Images.

Houston-based ExxonMobil and Rice University announced a master research agreement to collaborate on research initiatives on sustainable energy efforts and solutions. The agreement included multiple projects that were expected to be underway in 2025.

Houston expert: From EVs to F-35s — materials that power our future are in short supply

No critical minerals, no modern economy. Getty images

If you’re reading this on a phone, driving an EV, flying in a plane, or relying on the power grid to keep your lights on, you’re benefiting from critical minerals. These are the building blocks of modern life. Things like copper, lithium, nickel, rare earth elements, and titanium, they’re found in everything from smartphones to solar panels to F-35 fighter jets. Continue reading this guest column from Houston energy expert Scott Nyquist.

Greentown Labs announces newest startups to join Houston climatetech incubator

Five companies have joined Greentown Labs Houston, specializing in various "green" applications, from converting plastic waste into sustainable materials to developing energy-storage solutions. Photo courtesy Greentown Labs.

Greentown Labs added five startups to its Houston community in Q1 of 2025. The companies are among a group of 19 that joined the climatetech incubator, which is co-located in Houston and Boston, in the same time period. The companies that joined the Houston-based lab specialize in a number of "green" applications, from converting plastic waste into sustainable materials to developing energy-storage solutions.

Houston cleantech company expands into China with hydrogen energy pilot

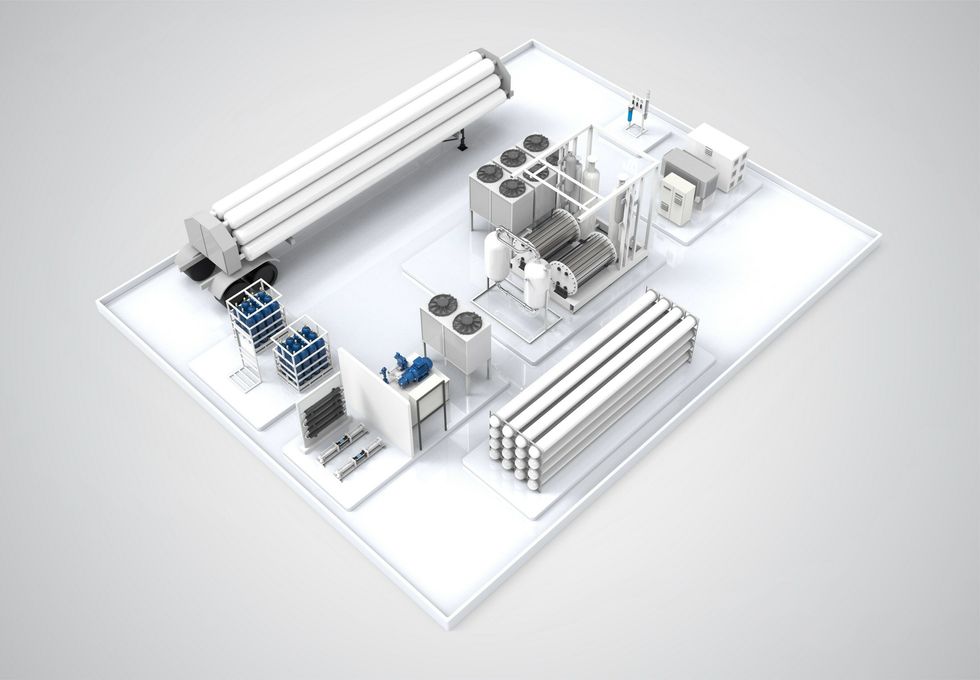

HNO International is partnering with Zhuhai Topower New Energy Co. to deploy its modular SHEP technology in China. Graphic courtesy of HNO

Hydrogen-based clean energy technology company HNO International announced its first foray into the Chinese market this spring. The company, which is building a state-of-the-art hydrogen production and refueling facility in Katy, entered into an agreement with renewable energy company Zhuhai Topower New Energy Co. This initiative includes a pilot deployment of HNOI’s Scalable Hydrogen Energy Platform, or SHEP, in China.

CenterPoint reports progress on grid improvements ahead of 2025 hurricane season

CenterPoint Energy aims to complete its suite of grid resiliency projects before the 2025 hurricane season. Photo via centerpointenergy.com

As part of an ongoing process to make Houston better prepared for climate disasters, CenterPoint Energy announced its mid-year progress update on the second phase of the Greater Houston Resiliency Initiative (GHRI). CenterPoint reported that it had completed 70 percent of its resiliency work, and that all GHRI-related actions were expected to be complete before the official start of the 2025 hurricane season.

Daikin completes solar plant to power massive Houston-area campus

Daikin Industries' new solar power plant at its Waller-area campus will power its central chiller plant and is designed to connect to the campus' electric grid. Photo courtesy Daikin.

Japanese HVAC company Daikin Industries completed a nearly one-megawatt solar power plant at its Daikin Comfort Technologies North America campus southeast of Waller. Daikin said the new plant at its 4.2 million-square-foot Daikin Texas Technology Park will eliminate an estimated 845 metric tons of carbon emissions each year. The park houses the largest HVAC factory in North America.

Houston earns No. 3 spot among cities with most Fortune 500 headquarters

Twenty-six Houston-area companies landed on the latest Fortune 500 list. Photo via Getty Images

Houston maintained its No. 3 status this year among U.S. metro areas with the most Fortune 500 headquarters. Fortune magazine tallied 26 Fortune 500 headquarters in the Houston area, behind only the New York City area (62) and the Chicago area (30).

7 Houston energy-focused businesses among Time's best midsize companies 2025

7 Houston energy-focused businesses among Time's best midsize companies 2025